Impact of Sanctions on Household Welfare and Employment

DJAVAD SALEHI-ISFAHANI

EXECUTIVE SUMMARY

Harsh sanctions against Iran aim to put pressure on the country’s leaders by making life difficult for its citizens. So far, sanctions have succeeded in creating an economic crisis and hurting the welfare of ordinary Iranians. This paper examines the impact of sanctions since 2010 on household consumption and employment. It finds that while household incomes and consumption have taken a serious beating, employment has been more resilient.

The effect of sanctions on the economy has been twofold, to limit the government’s revenues from oil exports and to cut the country’s trade with the outside world. Reduced export earnings cause devaluation, which fuel inflation and hurt household budgets. Lower government revenues cause economic contraction, which hurts both consumption and employment. Taking advantage of survey data on household consumption, this study shows how a rising trend of per capita expenditures turned negative after 2010, and accelerated downward after the U.S. withdrawal from the nuclear deal in 2018 and the start of the Trump “maximum pressure” campaign.

Employment took a different trajectory as devaluation increased the profitability of Iran’s non-oil tradable sectors and encouraged import substitution. In particular, employment in manufacturing continued to grow, and only stopped with the arrival of the Covid pandemic in 2020. However, because the modest increase in employment was the result of lower real wages, rising employment could not slow down the decline in living standards. The increase in employment was modest because sanctions limited the ability of Iranian exporters to take advantage of the lower cost of labor to increase their sales abroad.

The impact of the economic crisis was not distributed equally, with rural households taking the brunt of the crisis. Since 2010, poverty rates have doubled in rural areas, and increased by 60 percent in urban areas. The Islamic Republic’s previous good record of halving the poverty rate in the previous decade, from over 20 percent in 2000 to less than 10 percent in 2010, fell victim to the government’s shrinking revenue base and the speed with which Trump’s sanctions and the pandemic hit the economy.

Unlike in 2011, when a newly introduced cash transfer program shielded the poor from the negative consequences of the tightening of sanctions under President Obama, in the last two years the Islamic Republic’s extensive welfare agencies and its much-weakened cash transfer program have proved ineffective in preventing a large drop in consumption across the spectrum and thus preventing poverty from increasing. Since 2011, about 8 million individuals have descended from the middle class into the lower middle-class strata, while the ranks of the poor has swelled by more than 4 million. The problem was compounded by the arrival of the Covid pandemic in 2020. In addition to lacking resources to assist those who lost their jobs, the government has not been able to easily reach the majority of Iranian workers who hold informal jobs.

INTRODUCTION

Sanctions imposed on the trade and finance of a country aim to influence the behavior of that country’s government, but almost always do this indirectly, through pressure that mainly affects the country’s ordinary citizens. Sanctions produce a negative macroeconomic shock that reduces the economic welfare of some or all sectors of the population. Their proponents believe that popular discontent resulting from loss of welfare puts pressure on the government of the sanctioned country to change its policies in the desired direction. Sanctions thus raise two types of questions. First, how large is their impact on average welfare, and who bears most of that impact: the officials who are formally the target of the sanctions, their support base in society or innocent by-standers? The answer determines how likely sanctions are to succeed. Secondly, sanctions raise serious normative concerns, in particular of collective punishment, which has been banned by the Geneva Conventions (Weisbrot and Sachs 2019) [1]. Measuring the impact of sanctions on the living standards of various social groups is accordingly of interest to those who impose sanctions and those who are concerned with the suffering of innocent people caught in the crossfire of international conflicts.

Iran has been under the harshest sanctions in modern history for several decades. These intensified after May 2018, when President Donald Trump withdrew the U.S. from the Iran nuclear deal (JCPOA) and began its “maximum pressure” campaign. Iran’s GDP, which stagnated during the first phase of sanctions under President Obama, has since been shrinking. Most recently, the Covid pandemic has added to the damage done by sanctions. This paper examines sanctions’ impact on household welfare, as measured by household consumption and employment survey data. Its estimates show a much greater impact on average consumption than previously suggested by simulations [2]. In addition, survey data make it possible to estimate the degree of setback in different parts of the distribution of consumption.

The analysis that follows describes how the outcomes of interest, consumption, poverty and employment have changed after the imposition of sanctions. It falls short of a causal analysis in which the link between specific sanctions and outcomes are established and other factors that can influence the outcomes are held constant. In this sense, the study follows others on the impact of economic crises on household welfare that do not identify the mechanisms involved [3]. As with economic crises caused by other large negative macroeconomic shocks, however, there is little doubt that sanctions, by cutting its oil exports and hindering its external trade, have dealt a serious blow to Iran’s economy and the living standards of ordinary Iranians. In the short span between 2016 when sanctions were eased and 2018 when they were reimposed, the economy switched from GDP growth of 13 percent to minus 6 percent. It is, therefore, plausible to speak of impact without implying precise causal identification, when changes in consumption or employment closely follow the economic crisis induced by the imposition of sanctions.

The study discusses changes in consumption and employment in separate but closely interconnected sections. For most people, vulnerability in consumption is a direct result of insecure access to employment. Income from work supports more than half of consumption expenditures, more so for the poor. Significantly, sanctions may have helped on the employment side, as they appear to have boosted jobs in import-competing sectors. However, because they have cut earnings, as shown in Section III, the overall impact on living standards has been negative.

The study relies heavily for the bulk of its consumption and employment analysis on micro data from two surveys collected by the Statistical Center of Iran. Household income and expenditure data are reliably reported in the Household Expenditure and Income Survey (HEIS), collected annually for nearly five decades; its micro level data are available since 1984.

Employment analysis depends heavily on the Labor Force Survey (LFS), collected seasonally and available in micro data since 2005. Reliance on micro-level data is important because trust in Iran’s published economic statistics is low, especially in the West, where the debate on the impact of sanctions is highly contentious, and pundits cite widely divergent statistics to make their points. For example, comparisons of living standards before and after the revolution can be very different [4]. The proportion of people below the poverty line also ranges widely, from 70 percent to less than ten percent. In such a contentious atmosphere, statistics derived from micro data from household surveys are essential for arriving at a reliable picture of the economic situation.

The paper also briefly discusses how the Iranian government has responded to the shock by increasing social assistance and letting the currency depreciate as a way of stimulating employment [5].

The main conclusion from the analysis of consumption is that, at least in terms of timing, there is evidence that sanctions have reduced the living standards of the average Iranian and increased poverty. Despite attempts by the government to reach the poor with cash and in-kind transfers, poverty has grown in the last two years, especially in rural areas. During 2011-2012, cash transfers moderated the impact of the Obama sanctions, and poverty rates actually declined. But in 2018, under Trump sanctions, cash transfers were not of much help because their real value had declined due to high inflation, allowing poverty rates to increase.

In contrast, the conclusion from the analysis of employment is that sanctions may have actually promoted employment. This is because, in response to the loss of oil exports, the government allowed the currency to depreciate rapidly, which stimulated local production of import-competing goods. Employment in general does not fluctuate much in Iran because of labor market rigidities. Depreciation likewise lowered the average wage in the country relative to Iran’s trading partners, thereby increasing the competitiveness of local production.

An attempt is also made to cover pandemic-related changes in consumption, poverty and employment, but consumption data cover only one month of the pandemic. Covid hit Iran much harder than its neighbors, however, and published reports indicate severe loss of income and jobs. Micro data for the last month of the Iranian year 1398 (19 February-20 March 2020) show a much larger impact of the pandemic relative to the shock dealt by sanctions.

I. HOUSEHOLD WELFARE

As a large negative shock to the economy, U.S. sanctions have naturally affected the living standards of ordinary Iranians. This is reflected in the most accessible measure of living standards, GDP per capita, as well as in survey-based measures of household consumption. Figures 1 and 2 below show that the rise and fall of GDP per capita and per capita expenditures are closely related. Therefore, the lessons from the national accounts and survey data are similar: a long period of rising living standards came to an end around 2010, when sanctions tightened during the first Obama administration, and the easing of sanction following the 2015 nuclear deal led to robust growth in 2016-2017, which ended quickly once Trump sanctions began in 2018.

A noteworthy feature of Iran’s economy revealed by the national accounts is the difference between the trends in GDP and non-oil GDP, which follow the same path as the per capita values depicted in Figure 1. Non-oil GDP, which measures economic activity by 98 percent of the Iranian work-force and is therefore more closely related to employment and productivity, continued to grow when GDP began to falter after 2008. The fact that other sectors were able to increase their share of GDP following the loss of oil exports is a less appreciated feature of the economy that has played an important role in its ability to withstand sanctions [6]. However, this resilience at the macro level did not prevent a sharp decline in living standards, observed in survey data and shown below, because the increase in employment was in large part made possible by a decline in real wages.

A. AVERAGE LIVING STANDARDS

The national accounts data in Figure 1 show non-oil GDP per capita rising, albeit very slowly, even as oil income shrank after 2010. Data on personal consumption obtained from expenditure surveys reveal a more dire picture in which the average standard of living fell by 17.7 percent during 2010-2019. As a result, per capita consumption in 2019 had returned to its level in 2002. The economic crisis had not only deprived Iranians from increasing their living standards since 2010; it had erased nearly a decade of previous progress.

Deviations between the performance of the macroeconomy and personal consumption is not unusual. They can arise for a number of reasons, for example if over time more resources shift to the government or the corporate sector, or go abroad [7]. Inflation, which is a form of taxation and has averaged over 20 percent during the past decade, is probably an important source for the shifting of resources from households to the government. Capital flight, mainly in the form of export earnings that fail to return to Iran, is another important factor [8].

Not all the 17.7 percent standard of living decline in the last decade can be attributed to sanctions. The fall in oil prices, first in 2008, then again in 2014, has also played a role. While sanctions limited the volume of oil exported, lower prices meant less was earned from what was exported. The one sure sign that sanctions have been the most binding constraint on economic activity, if one is needed, is the sharp GDP increase (13 percent) in 2016, when oil prices were still low, but sanctions had eased. Unsurprisingly, economic actors took advantage of the brief respite in sanctions and unused production capacity to expand output.

Survey data tell an even more alarming story when we disaggregate average consumption by region. Figure 2 depicts average per capita expenditures for Tehran, other urban areas and rural areas deflated by the consumer price index for rural and urban areas, as well as a cost of living index derived from the poverty lines for the rural and urban areas of all provinces [9]. According to this measure, while all regions benefited from growth before 2010, mainly thanks to rising oil revenues, the contraction was not equally shared. All were hit hard initially with the temporary oil price collapse in 2008, which was quickly followed by sanctions [10]. Whereas in Tehran average consumption stayed flat after 2008, in the rest of the county it declined significantly (by 30 percent in rural areas and 11.6 percent in other urban areas). Surprisingly, Tehran residents on average did better (by 9.1 percent) in 2019 than in 2010.

The differential impact of economic contraction on average consumption in Tehran and the rest of the country could have a number of reasons. Tehran’s economy is more diversified, enabling residents to adjust more effectively to sanctions and recession. Also, the share of state and white collar jobs, which were better protected during the crisis, is higher. Rural and smaller urban areas have fared least well. They are more distant—geographically and politically—from the centers of power and the public purse, so benefit less from government social protection policies. This distance increased with the ascent of the neoliberal administration of President Hassan Rouahni, which replaced the populist government of Mahmoud Ahmadinejad in 2013.

The more pronounced decline in rural consumption is probably due to additional factors. The agrarian economy has been under stress from environmental factors, such as a decade-long drought and falling water tables [11]. Higher inflation in rural areas is another potential factor, but expenditures have been deflated using separate Consumer Price Indices (CPI’s) for rural and urban areas. Since 2011, when the divergence in poverty rates between rural and urban areas emerged, prices have risen by a factor of 3.3 in urban areas and 3.4 in rural areas. Another potential factor is selective migration. Average consumption can decline faster in rural areas if the more affluent households leave for the cities. But little evidence exists to support this conjecture. According to the Labor Force Survey, which asks if a worker has recently changed place of residence, on average 0.3 percent of the rural population moved to cities per year during 2018-2019. This was lower than the 0.5 percent migration per year averaged during 2010-2012, when rural incomes were boosted by uniform cash transfers, and poverty actually fell. Furthermore, the more educated (and therefore the more prosperous) have not especially engaged in migration in recent years [12].

These figures correct two widely held misunderstandings regarding the current state of Iran’s economy. The proponents of sanctions often point to economic stress after 2011 as evidence that it is in free fall and close to collapse, raising hopes that tighter sanctions would soon force Iran’s leaders to capitulate. Occasionally, to deflect criticism that sanctions are inhumane because they hurt ordinary Iranians during a pandemic, they blame the suffering on corruption and economic mismanagement [14]. Corruption and mismanagement no doubt play a role in the overall sluggish economic growth of the past four decades, but they do not explain changes in the growth rate from one decade to the next. The data in Figure 1 show that, first, the economy has not been in free fall; in fact, the level of economic activity, more accurately measured by the non-oil GDP, has been quite stable and rising slowly (see also Table 13 in the appendices). Secondly, the fact that incomes were rising before sanctions hit around 2010 undermines the claim that inherent factors are responsible for subsequent stagnation of living standards.

Divergent paths for the three regions is another lesson derived from this Figure. After the end of the destructive war with Iraq, in 1989, spatially adjusted consumption levels were about the same in all three regions. However, by 2007, when average consumption peaked, consumption in Tehran was one-third higher than rural and 15 percent higher than other urban areas. This divergence may be in part due to the changing composition of the Iranian population by residence. Each year roughly 0.5 percent of the rural population becomes urban, some by moving to urban areas while others by having their village reclassified as urban. In Iran, villages with more than 5000 population can petition the state for reclassification. Although selection by income or education does not appear to be strong in migration to urban areas, reclassification is. More prosperous villages are more likely to expand and become urban. As a result, selection may be responsible for the faster decline in consumption in rural areas over the last decade, though not for a single year, such as 2019.

B. POVERTY

In most developing countries, the poor are more vulnerable to negative external shocks, because they lack the savings to ride out a temporary shortfall in income. They also lack the political power to direct government resources toward their needs. Iran is known as a populist state with strong revolutionary rhetoric in favor of the poor.

Whether it has been better able to shield its poorest citizens from the economic crisis induced by sanctions can be answered with fair precision, because Iran regularly collects income and expenditure surveys and, more importantly, releases their results in unit record for use by researchers. These micro data provide a detailed view of the distribution of household welfare since 1984 and during sanctions. While the exact causal link between sanctions and the poverty status of individuals is difficult to establish, the timing of changes in poverty are highly suggestive of such a link.

Poverty is usually measured by first locating a nutritionally or socially determined threshold of income or expenditures below which people are considered poor. Iran does not publish official poverty lines, as its social protection system is not based on income data, so this paper uses a set of lines based on a methodology proposed and implemented for rural and urban areas at the province level [15]. Expenditures per capita are expressed in 2019 prices and adjusted for cost of living differences. A $5.50 poverty line (in Purchasing Power Parity dollars) that the World Bank has proposed for upper middle income countries is used to estimate the percentage of individuals below this threshold [16]. The choice of a particular line obviously matters for the estimated poverty level but not for its trend, our main concern. Some may consider $5.50 too low, but a higher level does not alter the observed pattern of change. Figure 3 shows poverty rates for the past three decades (1984-2019) for urban Tehran, other urban and rural areas. Table 12 in the appendices presents the data used to generate the graph. Because adjustment is made for the higher living cost in Tehran and other urban areas, poverty rates are not necessarily higher in rural areas, where nominal incomes are lower. In fact, until 2000, urban poverty rates were higher than rural. Over time, as the urban population’s proportion has risen, poverty has become more prevalent in cities. In 2019, of ten million individuals identified as poor in these calculations, 4.8 million lived in rural areas, 4.4 million in urban areas and less than 1 million in Tehran.

In all three regions, poverty rates follow the rise and fall of the average living standards observed in Figure 2. As expected, poverty is higher and more volatile in rural than urban areas or Tehran. All areas experienced declines in poverty rates during 2000-2007, when oil revenues were high and rising. Poverty stayed relatively stable and low until 2012, when Iran’s currency collapsed under the weight of Obama sanctions, after which they have been rising. The impact of the 2010 cash transfer program the Ahmadinejad government initiated is evident in falling poverty rates during 2011-2012, despite the tightening of sanctions and a stagnating economy [17]. After 2012, all poverty rates began to increase, rural poverty the fastest. The deepening economic crisis following the Trump administration’s “maximum pressure” campaign is evident in the sharply rising poverty rates across the country, from 8.1 percent in 2017 to 12.1 percent in 2019. The increase of four percentage points means that 3.2 million Iranians fell into poverty in two years [18]. In 40 years, poverty rates have risen twice before: in the mid-1980s as a result of the destruction due to the war with Iraq; and in the mid-1990s, when post-war restructuring caused a recession. The most obvious reason for the sharper increase in rural poverty after 2012 is the economic crisis precipitated by the tightening of sanctions.

As with the consumption decline discussed above, other factors such as drought and government policy may have contributed to the deepening rural poverty. Though sanctions in 2011-2012 were not as severe, since they did not reduce Iran’s oil income as much as in the last two years, the introduction of a large cash transfer program did much to limit rural poverty. The Rouhani government could have done the same despite the tighter budgetary situation; reducing subsidies on energy (and even taxing it) is generally a progressive type of revenue generation. It chose not to replace the subsidies with cash transfers early on since it was ideologically opposed to cash handouts. When it hiked gasoline prices in 2018, it did not offer compensating transfers until violent street protests forced its hand.

C. THE MIDDLE CLASS

The economic crisis has adversely affected the welfare of individuals across the income distribution, not just the poor. Whereas the number of those below or close to the poverty line matters because they are least able to deal with a loss of income, the size of the middle income groups also deserves attention. For one thing, the poor qualify for various types of government assistance, while middle income groups do not and must depend on their own sources of income. The “lower middle class”—those not far enough above the poverty line to keep that status as the crisis deepens—are as vulnerable as the poor and need social protection in a deteriorating economy. The concern with the state of the “middle class”— those far enough above the poverty line not to be at risk of becoming poor—is damage to longer term social and economic development. The middle class is generally considered the main driving force in social and economic development, its size associated with many markers of economic growth such as better education, health and infrastructure, as well as factors associated with democracy such as inclusive growth, good governance and political stability [20]. Freed from the daily struggle with mere survival and feeding their families, it becomes interested in building institutions that promote good governance and economic growth rather than support zero-sum policies of redistribution, and believes in greater engagement with the global economy as a means to achieve these goals [21].

Measuring the size of the middle class, as in the case of the poor, involves defining income or expenditure thresholds. This paper adopts the thresholds commonly used in development economics that define the middle class as those earning (or spending) above twice the poverty line ($11 per person per day in PPP dollars for Iran) [22]. Other income groups are defined similarly: those between the poverty line and the middle class are labeled the lower middle class; those above $55 (ten times the poverty line) as upper middle class. Since Iran’s truly rich do not appear in the HEIS sample, this highest income group is labeled upper middle class. Per capita expenditures are again adjusted by cost of living differences across rural and urban areas in all provinces.

Figure 4 depicts the evolution of the shares of these four income groups. The middle class is the largest, having increased its share of the population from one-third in the 1990s to close to 60 percent in the late 2000s. During the same period, the poor dropped from one-third to less than ten percent. The shares of the groups classified as lower and upper middle class do not change much over time, so the pre-dominant feature of social change in Iran during the two decades before sanctions

is the rise of the middle class. This was the result of large public investments in health and education infrastructure in the 1990s, mainly in rural areas, and the oil boom of the 2000s, as well as the decisions of millions of families that demanded these services from the government and invested their own resources in their children’s education and health [23]. Public and private actions played a role to lift millions out of poverty and into the middle class. However, since sanctions intensified in 2011, the share of the middle class has fallen by 10 percentage points, from 58.4 percent of the population in 2011 to 48.8 per cent in 2019, meaning about eight million fewer people than expected if the share had remained constant.

The Iranian middle class is well educated: close to 50 percent of its members live in households whose head is a high school graduate or above. Like elsewhere in the world, it has been the backbone of economic development and social and political reform. It has played a key role in the election of reformist and moderate presidents, Mohammd Khatami (1997-2005) and Hassan Rouhani (2013-present), both of whom championed liberal economic reforms and pursued closer integration with the global economy. It is fair to argue that besides causing much hardship, the economic crisis precipitated by sanctions has made political and economic reform less likely and undermined Iran’s potential future role as a force for moderation in a turbulent region and in the global community.

D. FOOD CONSUMPTION AND LIVING STANDARDS

Large negative macro shocks raise concerns about hunger or decline in the poorest households’ food and nutritional in-take. Income declines raise the share of food in total consumption until there is no more room for substitution from non-food to food expenditures. As a result, food’s share in total expenditures is a good predictor of poverty status [24].

Iran has seen some adjustment in the direction of necessities. The combined shares of food and housing, the main expenditure groups considered necessities, increased from 52 percent in 2010 to 57 percent in 2019, with most increase coming in the last three years. Interestingly, the same has not happened for the bottom quintile. Figure 5 shows that the shares of food and housing for the poorest quintile (42 percent and 26 percent, respectively) were higher than the national average but remained steady. The share of food expenditures alone, which according to the criterion suggested by Pritchett is correlated with per capita incomes, was lower than for the entire country in 1988 (45 percent), arguably Iran’s worst economic year and when the war with Iraq ended. For the country as a whole, the share of food was 30 percent in 2019, which suggests that as bad as conditions are today, food is taking a much smaller bite out of the average family’s budget than three decades ago.

E. THE COVID-19 EFFECT

The arrival of the pandemic in February 2020 has hugely exacerbated Iran’s economic woes. Unlike sanctions, which affected oil revenues first and the wider economy secondly, Covid affected a broad range of industries. Social distancing cut demand for many businesses, closing them down, and shut borders to neighboring countries where most exports headed as businesses sought to evade sanctions on trade and international transfers of money.

Data on Covid’s impact is hard to come by, but the HEIS collected close to a month of expenditures under the pandemic at the end of the Iranian year. Covid’s arrival was first announced on 19 February in Qom, from where it spread to other provinces. The government resisted imposing quarantine rules, while Nowruz travel took the virus to holiday resorts in Gilan [25]. The spread is reflected in the 2019 HEIS, which covers the month of Esfand (19 February-20 March 2020). The decline in real per capita expenditures for this month between 2018 and 2019 was much steeper than for the year as a whole (37.6 percent in rural areas and 31.7 percent in urban areas compared to 12.5 percent and 11.4 percent). Gilan and Qom provinces were much harder hit in March, because the pandemic arrived there from Wuhan, China first [26]. In Gilan, real expenditure in the year’s last month (deflated by that month’s CPI) fell by 27.3 percent in urban and 39.9 percent in rural areas, compared to average declines of 12.3 and 9.4 percent for the year. In the mostly urban province of Qom, urban real expenditures fell by 45.5 percent while rural expenditure declined by only 2.8 percent.

F. SOCIAL ASSISTANCE

As noted earlier, poverty dropped during the first wave of U.S. sanctions, in 2011- 2012, so what explains its increase during the second phase? There is little doubt that during the first wave the introduction of cash transfers under President Mahmoud Ahmadinejad was responsible for the decline in poverty [27]. That program, known as Targeted Subsidy Reform, aimed to replace hefty energy subsidies with direct cash payments deposited monthly in dedicated household accounts. They amounted to about 22 percent of median income in 2011, the first year of these payments, but in 2019 to only 5 percent [28]. The poor benefited substantially more from the monthly transfers, but even for them the benefits declined quickly as high inflation cut their real value. Table 1 presents the share of cash transfers for the five quintiles of income over time and shows that for the lowest these transfers amounted to over 40 percent of income in the early years but gradually declined to 15 percent.

Other official transfers, mainly from the welfare ministry and the Imam Khomeini Relief Agency, known as Komite Emdad for short, also form a significant part of government assistance. Official transfers to the poor are lumped together in the HEIS as ”scholarships and transfers from social institutions and charities.” It is plausible to assume that these are mostly welfare payments to the poor because they are disproportionately high for the poorest quintile and for families headed by women or older men. Table 2 shows the sources of income for individuals in the lowest 20 percent who also received official transfers. This table shows clearly that welfare payments were insufficient to prevent a 16 percent decline in their average per capita income (from $238 PPP in 2017 to $200 in 2019). During this period, welfare payments to this group—cash and other transfers—fell by 40 percent. The sizable decline in “Other transfers,” from $35.4 (PPP) in 2018 to $19.8 in 2019, is clear evidence of the decreased ability of the government to protect the poor as Trump’s “maximum pressure” campaign took its toll.

The contrast in the fortunes of the poor in 2011-2012 and 2018-2019 reflects both a policy shift from the populist Ahmadinejad to the neoliberal administration of Hassan Rouhani, as well as the greater severity of the fiscal constraint in the latter period. Whereas in 2011-2012 official transfers were more than twice the wage income of the welfare recipients in the bottom quintile of the income distribution, in 2019 they amounted to only 70 percent of wage income.

Significantly, in 2019, as transfers and “Other incomes” (mostly from retirement and rent) fell, wages and self-employment incomes rose (see Table 2), lessening the drop in the overall income of this group of welfrare recipients. This is consistent with the improved employment situation thanks to real depreciation and import substitution, which likely increased demand for unskilled labor.

G. INCOME DISTRIBUTION

Sanctions’ impact on income inequality is not as straightforward as on poverty. Iran has been generally successful in poverty but not inequality reduction. This is not surprising, because the distribution of human capital and therefore labor incomes is unequal [30]. Furthermore, Iranians receive income that originate from the oil rent, some through transfers and subsidies, some through access to government contracts and subsidized credit. The distribution mechanisms are complex, but, at least for the latter two channels, the politically connected have an advantage. This was true before the revolution and remains so today [31]. Inequality in political access produces inequality in income from the oil rent.

Measurement of inequality is less controversial than that of poverty, because no arbitrary choice is made akin to picking a poverty line. However, it is less accurate, because survey data are much less reliable for top than for low incomes. This is the well-known issue that afflicts most household surveys [32]. In 2019, the highest monthly income HEIS recorded was 68 million tomans (less than $8,000 using the free market exchange rate; about $30,000 using the PPP rate). Many rich Iranians own enough real estate to earn more in rental incomes alone. Lack of information on under-counting makes inequality discussion highly unreliable, but standard measures uniformly applied to different countries and over time can be very informative across time and space.

Figure 6 shows the path of four measures of income inequality: the standard Gini index; the ratio of incomes in the top to bottom decile; and two Entropy measures, the Theil Index, which behaves close to the Gini, and GE(2), which is more sensitive to changes in top incomes. All show relatively high inequality for most years, with Gini in excess of 0.40. They also show rising inequality since sanctions tightened, though a direct link cannot be established.

H. HEALTH INSURANCE

Access to health insurance is an important indicator of vulnerability in an economic crisis. Individuals who lack it are at risk of health shocks that can sink them into poverty. HEIS expenditure data is used here to identify individuals with such access. If a household reports health insurance expenditures, all members are marked as having access.

The proportion of individuals with access (defined as those living in a household where at least one member has insurance) has increased over time (Table 3). About 91 percent of rural and 75 percent of urban residents have access to insurance based on this definition. Most insurance is publicly provided or subsidized. Only about 6 percent of rural and 21 percent of urban residents have private, purchased insurance. This is why in Table 4 the proportion of individuals with insurance has increased faster for the bottom quintile (65.6-83.4 percent) than for the top (65- 73.5 percent).

I. DESCENT INTO POVERTY, 2018-2019

The HEIS surveys are rotating panels and thus provide the opportunity to analyze the movement of individuals between income groups. A panel consisting of the households that were interviewed in 2018 and 2019 rounds and did not change in composition is used to an analyze the movement of individuals into and out of poverty between these years when economic stress was at its height.

The estimates of mobility into and out of poverty are presented in Table 5, with poverty status defined using the absolute poverty lines introduced above. The majority of the poor and non-poor in the balanced 2018 sample remained in the same status in 2019, but 2,976 individuals who were not poor in 2018 found themselves in poverty in 2019. Fewer individuals moved in the reverse direction: 1,449 poor individuals in 2018 escaped poverty in 2019. On balance, 1,527 more people ended in poverty in 2019 compared to 2018. This is consistent with the increase in the poverty rate observed in Figure 3 and Table 12 in the appendices.

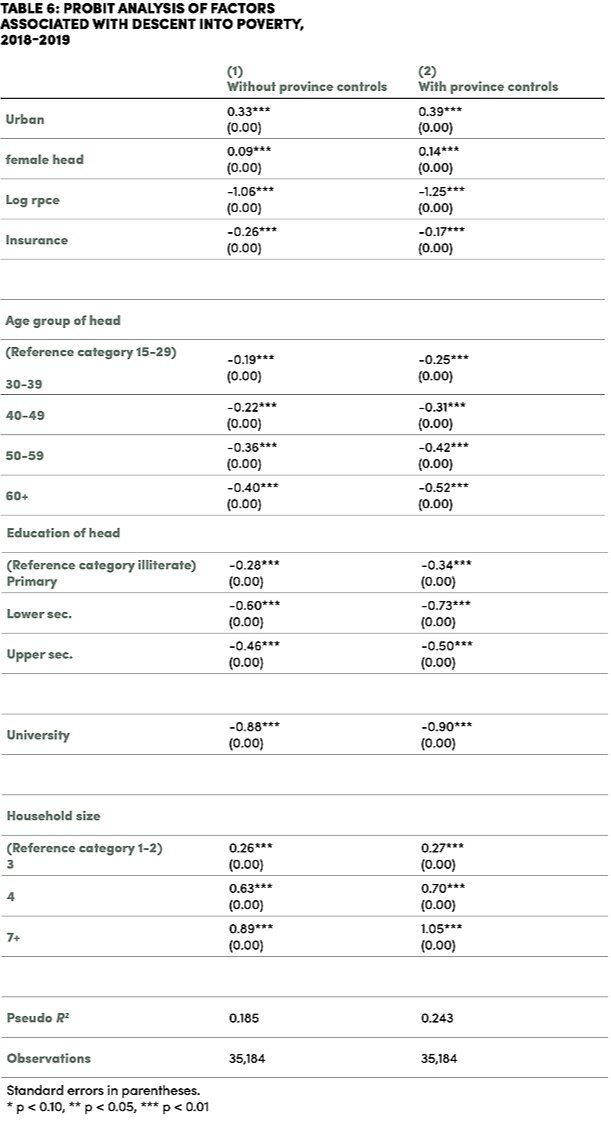

J. PROBIT ANALYSIS OF FALLING INTO POVERTY

The general increase in poverty in Iran in recent years and the plight of the rural population in particular have been the focus above, but poverty is not limited to rural areas, and there are as many poor persons in urban as in rural areas (about 5 million each). If poverty is not simply a matter of geography, it is important to ask what other characteristics of individuals besides location make them more vulnerable to becoming poor. To answer this, the paper takes advantage of the 2018-2019 panel of households to estimate the probability of an individual becoming poor – that is, being above the poverty line in 2018 and below it in 2019—as a function of location (rural-urban and province), and household characteristics such as age, gender and education of the household head, household size and per capita expenditures. A simple probit function is estimated for the probability of being poor in 2019 conditional on not being poor in 2018. The results presented in Table 6 offer several interesting insights.

Perhaps the most important is that during 2018-2019, conditional on household characteristics, urban residents were more likely to fall into poverty than rural residents, a finding that should be of value to Iran’s welfare organizations. This does not contradict what was observed in Figure 3, namely that rural residents on average have been at greater risk of poverty in recent years. The difference can be explained by variations in the characteristics of individuals in rural and urban areas. The probit analysis holds several of these characteristics constant, so what is compared is the probability of an individual living in a household with the average levels of household income, head’s education, etc., living in an urban area with a person with the same characteristics who lives in a rural area. These probabilities, which can be estimated from the coefficients reported in Table 6, estimate that with household characteristics constant, an urban individual was two-and-a-half times more likely to become poor in 2019 than a rural person (4.1 percent vs. 1.6 percent) [34].

Living in a family headed by a woman increases the risk of falling into poverty by 37 percent (in 2019, about 8 percent of individuals lived in such households). Predictably, health insurance reduces that risk by 35 percent. Also predictably, education is an important determinant. Those living in households whose heads have more than a high school diploma face a risk of less than 0.1 percent, compared to 7.2 percent for those in families whose head is illiterate (about 15 percent of individuals lived in such households). Those living in larger households are at greater risk of becoming poor, but risk decreases with the age of the household head. Living in households headed by older individuals decreases the likelihood of becoming poor. The oldest group (60+) has the lowest likelihood (2.3 percent) compared to the youngest (15- 29) age group (12 percent).

The coefficients of province dummies indicate that the effects of location on the likelihood of falling into poverty extend beyond the rural/urban division [35]. For example, all else equal, a resident of Tehran, the most advantaged province, is three times more likely to fall into poverty than a similar person in Sistan, the least advantaged province. This could be because, unlike in Tehran, in Sistan the characteristics that make a person poor are the same as those that determine descent into poverty. This means that the non-poor in Sistan are at a lower risk of becoming poor than the non-poor in Tehran. The lesson is that, despite the much lower poverty rate in more affluent areas such as Tehran, their residents are at a greater risk of falling into poverty. Simply put, location of residence is not a good predictor of vulnerability to the economic crisis.

II. EMPLOYMENT

Despite the significance of cash transfers, for most Iranians employment is still the main source of income. In 2019, the share of earnings from wage and salary work and self-employment accounted for 53.3 percent of rural and 47 percent of urban household incomes. The main sources of unearned income are retirement pay, cash transfers of various kinds and rent. Income from wage employment is more important than self-employment, accounting for 63 percent of all earnings. This suggests that any decrease in employment or wages would have a strong negative effect on average household incomes. Thus, to better understand how the negative shock of sanctions is transmitted to household budgets, it is important to understand what has happened to employment. The review of trends below suggests employment has been relatively stable compared to incomes and consumption.

A. TRENDS IN EMPLOYMENT

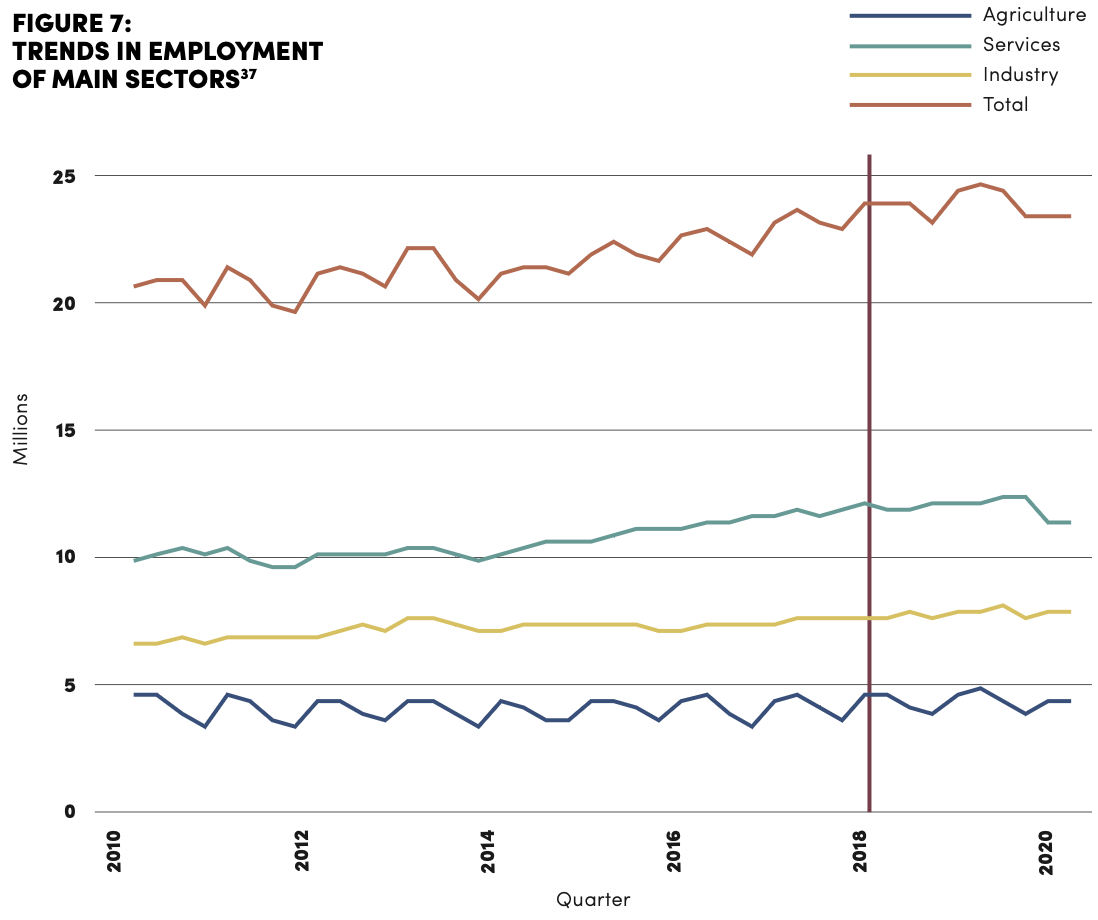

During 2010-2019, as sanctions intensified, GDP and average household incomes stagnated, but employment continued to grow, albeit very slowly. It was higher in all sectors in 2018 than in 2011, when sanctions first tightened. Figure 7 depicts

quarterly data published by Iran’s Statistical Center that show the total number employed grew from about 20 million in 2011 to 27 million in 2019, a 2.1 percent annual increase [36]. This exceeded the 1.1 per cent growth rate of the prime age (20-54) population during 2011-2016. Much of the increase was in services, which grew by 2.7 percent, followed by industry and agriculture, both 1.5 percent. The increase in the number employed in industry, the sector most exposed to trade sanctions, especially after 2018, indicates the positive effect of real depreciation of the national currency on local production. But the employment increase did not overturn the decline in wages in real terms, which is why poverty has risen despite higher employment.

This situation did not persist into the new Iranian year 1399 (2020/2021), when Covid’s initial negative effect on employment became evident. In spring 2020, the economy lost 1.4 million jobs, most of them in services, as two million left the labor market. Published data show a lower unemployment rate for the quarter (9.8 percent) compared to the previous year (10.9 percent), an artifact of a smaller labor force. During the second quarter (20 June-20 September 2020), the downward trend stopped, as Iranians went back to work despite the raging pandemic. Employment and the labor force were both higher than the previous quarter but still well below the same quarter a year be- fore. Unlike sanctions, Covid has taken a large toll on jobs.

B. TRENDS IN REAL WAGES

Wages play a dual role in any economy, as an income source and the largest production expense. The significant rise in real wages in Iran during the 2000s lifted many out of poverty, but, because the wage increase was not the result of higher productivity, it reduced the competitiveness of local production. Both phenomena are visible in the wage history of the turbulent past three decades. Figure 8 and the associated Table 16 in the appendices depict real wages for three regions, with all wages deflated by the rural and urban CPI’s and adjusted for cost of living differences. In all three regions, real wages were rising until 2008, when oil prices fell sharply due to the global financial crisis, and Iran’s economy contracted. This was soon followed by tightened sanctions, which ended the long stretch of rising wages. As with consumption per capita, real wages fell harder in rural areas.

Wages also rose in terms of U.S. dollars, indicating goods and services produced in Iran were becoming less competitive. This was a direct result of the oil boom, which raised wages and other types of incomes without necessarily increasing worker productivity. Between 2000 and 2010, the average nominal wage rose more than four times faster than the unofficial exchange rate, making Iranian goods more expensive relative to foreign goods. When Trump’s “maximum pressure” caused collapse of the rial in 2018, wages measured in dollars fell precipitously. In 2019, in dollar terms, the average wage was less than half its 2017 value. More than any other factor, this decline in the dollar value of wages was responsible for the modest increase in employment noted above.

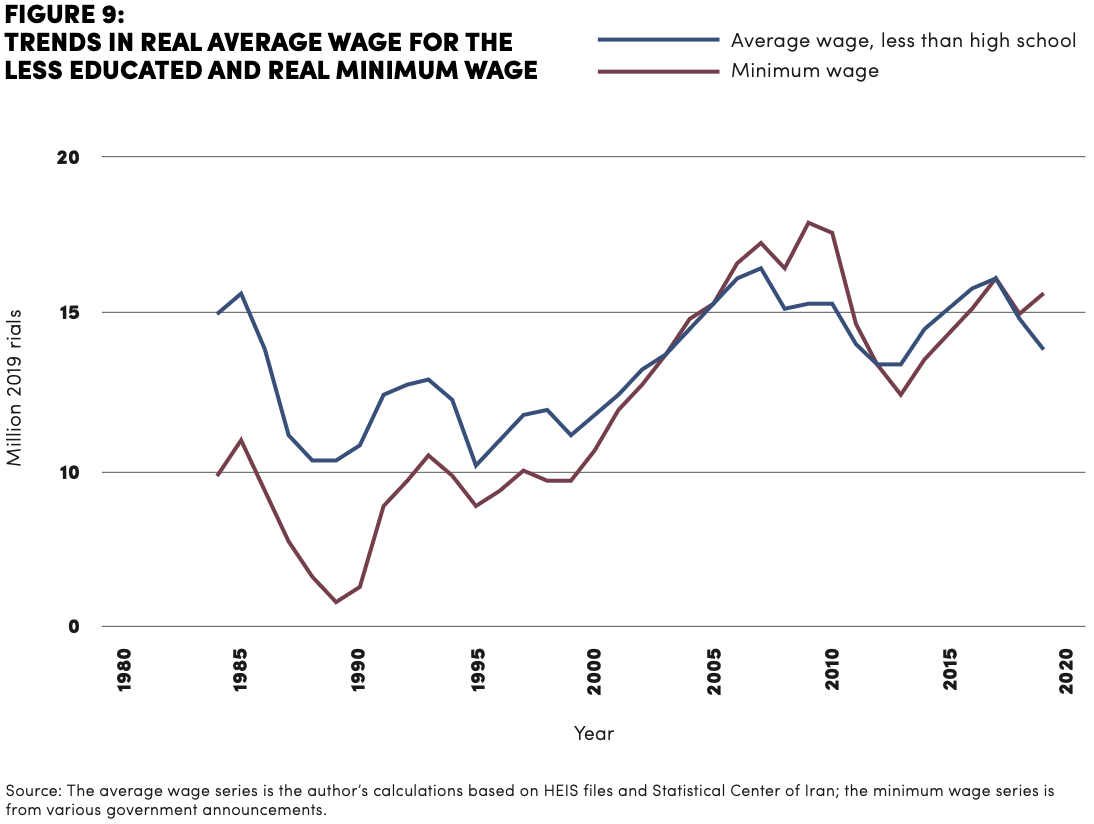

A final question for wages is whether the government used its power to set the minimum wage to protect real wages of the least advantaged workers. There are two limitations to the minimum wage as a tool to affect the incomes of the poor. First, minimum wage laws are very hard to enforce. In 2019, 48 percent of workers reported monthly wages below the minimum. Secondly, raising the minimum wage can reduce demand for labor. Despite these caveats, every year the government, with wide media coverage and following negotiations with the parliament, announces the minimum wage for the year using the previous year’s inflation as a guide.

Figure 9 shows how the real value of the minimum wage has compared with the average wage of workers with less than a high school education, the group that the law is presumably aiming to help. The wage depicted here is the base value of the minimum wage, to which about 15-20 percent is added for family and housing allowances. The movement of the two series is broadly similar. Until the mid 2000s, the real minimum wage was below the real wage for those with less than a high school education. Gradually, especially after 2000, as education increased and less educated workers were increasingly assigned to less productive tasks, the growth of the real wage for less educated workers slowed, while the minimum wage continued to grow. The oil boom enabled the government to raise the minimum wage much faster than before, so that by 2005 the minimum wage had exceeded the average wage for low educated workers.

C. THE STRUCTURE OF EMPLOYMENT

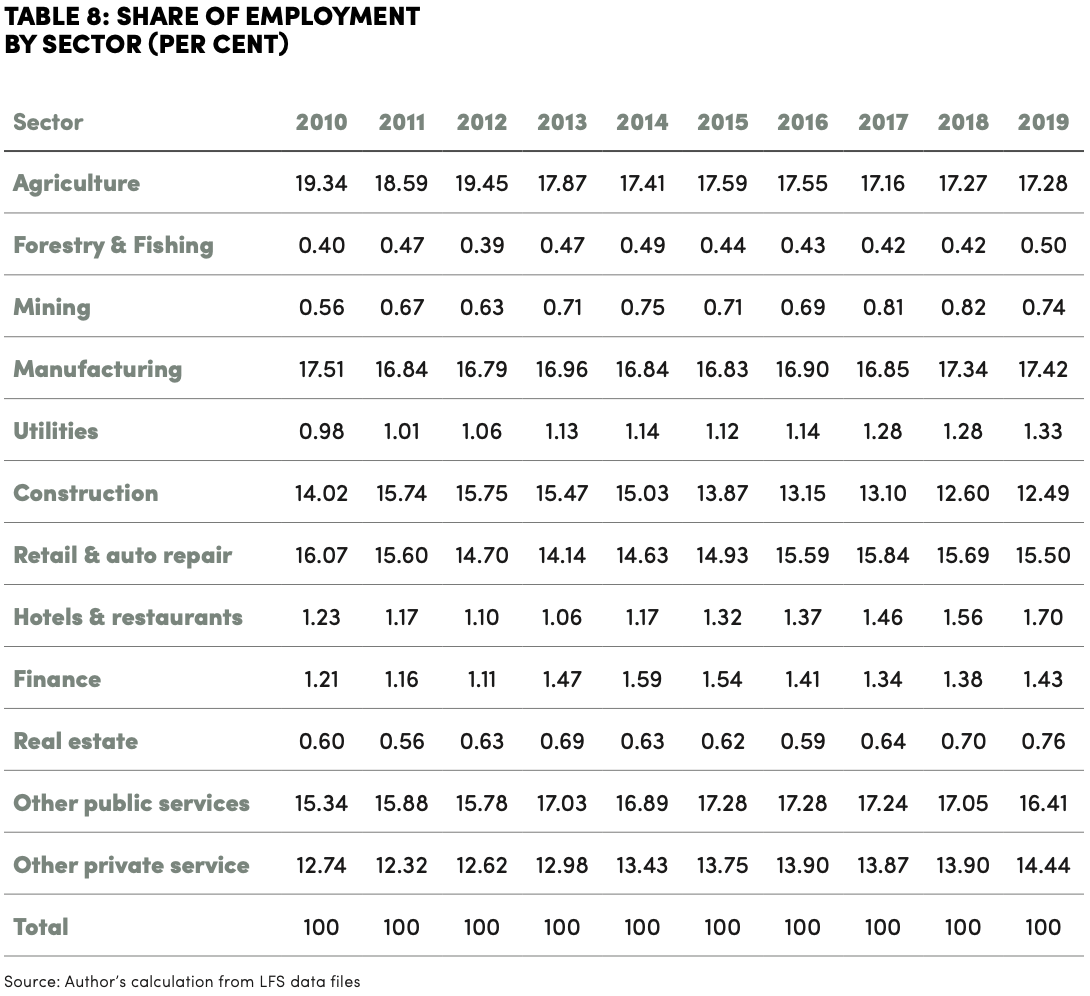

As in most upper-middle income countries, about half of Iran’s 26 million labor force is employed in the service sector, with industry and agriculture taking the other half. In 2019, agriculture’s share was 17.7 percent, industry (including mining, construction and utilities besides manufacturing) 32 percent, and services 50.3 percent (Table 7). The slight shift in employment shares over the decade away from agriculture and in the direction of services seems at odds with the change in the distribution of value added between these sectors. In general, employment in Iran is relatively rigid, so the differential impact of sanctions on the main sectors is less evident in employment than in production. During 2011- 2019, valued added in both agriculture and services, which were better shielded from trade and thus sanctions, grew by 26.9 percent and 24.2 percent, respectively. In contrast, industry shrank by 19.7 percent, but its employment share stayed basically constant. Most of the decline in industry was from reduction in oil production for export. Production in the oil and gas sector, which accounted for one-half of industrial production in 2011, was down by 47.2 percent in 2019. But manufacturing production, less affected by sanctions, was down only by 11.2 percent compared to 2011.

A more detailed view of the employment structure is available from Table 8. The diversity of sanctions’ impact on different sectors is seen in the divergent behavior of employment shares in manufacturing relative to other sectors in the industry group, such as construction. Whereas the share of construction in total employment was only slightly below manufacturing in the early years of the decade (16.8 vs. 15.8 percent), by 2019 it was considerably lower (17.4 vs. 12.7 percent). The difference is that construction declined as overall demand fell, but manufacturing was helped by real devaluation of the national currency, which promoted the substitution of local for foreign goods.

The large share of services, a sector not directly impacted by sanctions, explains employment’s stability in the face of sanctions. But the pandemic had the opposite effect, as services suffered the largest decline in employment. Whereas by summer 2020 the loss of industry jobs was limited to 43,000 (about 0.5 per cent of all industrial workers), the loss in services was over 800,000 (7.2 percent).

D. EMPLOYMENT VULNERABILITY AND INFORMALITY

1. PUBLIC VS. PRIVATE

In 2019, 13.4 percent of all workers and 21.6 percent of all wage and salaried workers were in the public sector, down from 22.7 and 43.1 percent, respectively, in 1997, when public employment peaked. Government workers have stayed relatively constant, around 3.5 million. Public sector jobs are traditionally considered more secure than private sector jobs or self-employment. However, their security has changed significantly in the last two decades, as ever more employees are hired on contracts of less than a year so as to avoid tenure. As a result, job security is no longer defined by public employment, but rather by the worker’s education and the degree of formality of employment. In 2019, 27.1 percent of the employed had a college degree or above, and another 29.5 percent had high school diplomas. These ratios are lower in the private sector, where 52.9 per cent of workers had less than high school degrees, 29.9 percent had only that degree, and 17.2 percent had at least a college degree. A large proportion of those with less than high school degrees are likely also informal workers, whose jobs can be considered vulnerable.

2. INFORMALITY

Informality in employment presents a serious challenge to social protection in times of economic crisis. In advanced countries, where the vast majority are registered and covered by unemployment insurance, workers are automatically protected from negative economic shocks, at least for a period. Even after unemployment insurance disappears, the fact that their previous employment status is recorded makes it easier for the government to reach them with further income assistance. Informal workers, on the other hand, lack unemployment insurance and a pension, so are not only at more risk of falling into poverty when a crisis hits, but are also harder to reach with additional help. For these reasons, the degree of informality in the labor market is an important determinant of the severity with which an economic crisis causes distress in household welfare.

Like most developing countries, Iran has its share of informal employment, but its labor force surveys do not offer a ready indicator of the extent. The labor force survey does not ask if workers have a contract or are otherwise registered with the authorities, so a precise measure of informality is not available. But an estimate can be derived from some reported job characteristics. Public sector jobs are, of course, formal, as are jobs that offer health insurance or pension. The survey distinguishes private and public employment and asks if a worker receives health insurance through an employer. There is no question about enrollment in a pension or the national social security program.

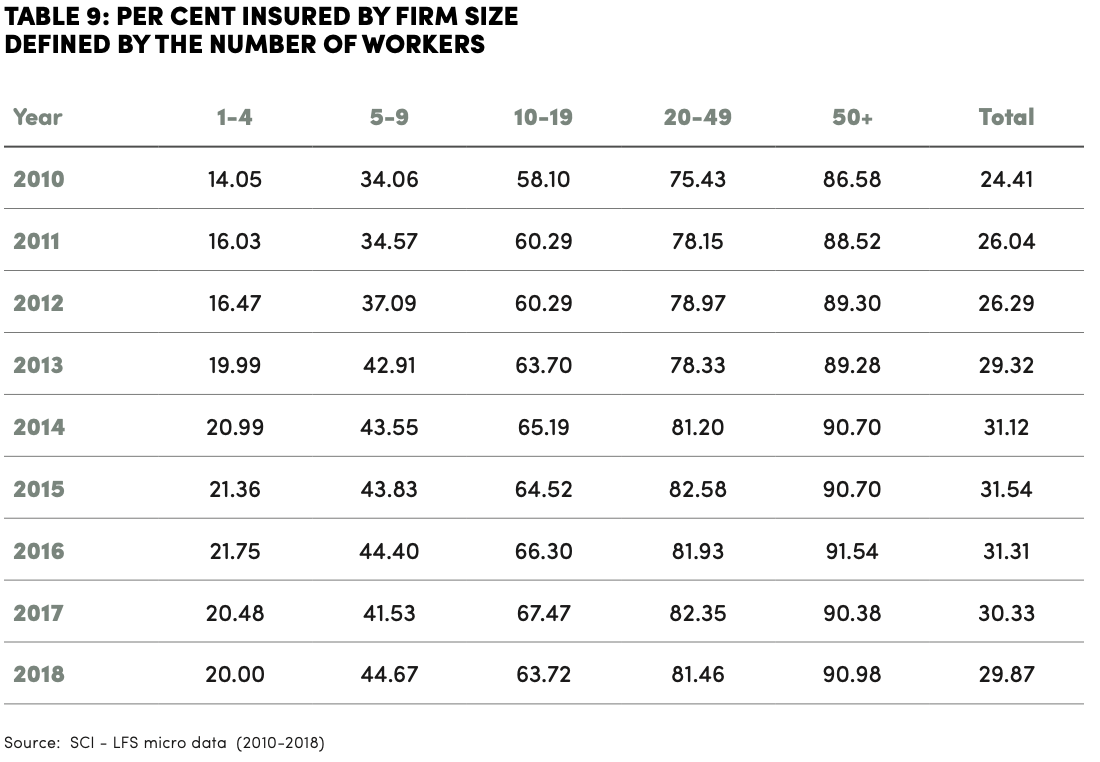

The survey also reports the sector, occupation and size of establishment of each worker. These characteristics offer some insight into the extent of informal employment. About 74 percent are in enterprises with fewer than five workers. Such enterprises often do not register with the government and often evade taxes and the regulations that require them to offer health insurance and contribute to pension programs. In 2018, only one in five workers in these enterprises had health insurance through their employers, a good indication that four out of five workers in micro enterprises are informally employed. In contrast, 91 percent in enterprises with more than 50 workers reported employer-provided insurance (Table 9). If we consider all who do not get insurance through their employer as informally employed, about 70 percent of workers would be so classified, higher than the Iranian media reports [39].

The lowest percentage of insured workers are in agriculture (8 per cent in 2018 in Table 10), followed by construction (25 percent). In 2018, those sectors together accounted for 30 percent of the workforce. The economic crisis following the imposition of sanctions in the last few years has hit construction the hardest, while, at least so far, agriculture has been spared. Turning to occupations (Table 11), unsurprisingly, unskilled workers are least likely to be insured (21 percent). Manufacturing and formal services (such as banking) have much higher rates of insurance.

III. CONCLUSION

There is no question that severe sanctions since 2011 have dealt a large blow to Iran’s economy. They have cut oil exports to a trickle and disrupted its international trade. There is also no doubt that other factors, internal and external, have also played a part in the last decade’s sluggish growth. Lower oil prices since 2014 have further reduced revenues, while economic mismanagement and corruption have prevented appropriate policy responses to the external shocks. Given the magnitude of the external shock due to sanctions, no policy could have prevented an economic crisis or fully shielded ordinary Iranians from a loss of living standards. One contribution of this paper is to measure the extent of the decline for different regions and on different income groups. How much of the decline is due to sanctions or which policies could have better limited the damage are questions that it cannot answer.

With respect to living standards, the main findings are: First, average per capita consumption has fallen significantly since U.S. sanctions tightened in 2011. In 2019, it was down by 17.7 percent from 2010 and back at the level reached in 2002. Secondly, the per capita consumption loss was not equally shared. Rural areas were worst hit,followed by urban areas excluding Tehran. Compared to 2010, average consumption was down by 30 percent in rural areas and 22.6 percent in other urban areas, but up by 9 percent in Tehran.

Thirdly, poverty rates increased across the three regions. Nationally, they nearly doubled, from the lowest point of 6.4 percent in 2012 to 12.1 in 2019. That is, four million more people had consumption levels below the internationally set poverty line of $5.50 PPP in 2019 than in 2012. As expected, poverty rates were the highest in rural areas (22.9 percent), followed by other urban areas (8.8 percent) and Tehran (7.5 percent). Significantly, a government cash transfers policy implemented by ex-President Mahmoud Ahmadinejad prevented poverty rates from rising after the first wave of sanctions, in 2011-2012, and even lowered them. During the second phase, 2018-2019, the Rouhani administration was much less generous with cash transfers, in part because of ideological opposition and in part because it lacked the necessary resources.

Fourthly, taking advantage of panel data collected in 2018 and 2019, probit estimates reveal household characteristics that are most correlated with falling into poverty in 2019. The analysis shows some common patterns found elsewhere in the developing world, namely that belonging to households headed by a woman, a less-educated person and larger in size put a person at greater risk of becoming poor. But, surprisingly, urban residents were more likely to fall into poverty than a rural person with the same characteristics, though the poverty rate is higher on average in rural than in urban areas.

Finally, the impact of the economic crisis has been less severe on employment than on consumption. This is in part because employment in Iran is fairly rigid and does not respond quickly to contractions in out-put. It is also because the government allowed prices to rise and the currency to depreciate rapidly, making local production more competitive in certain manufacturing sectors. While this policy made employment relatively resilient to the shock of sanctions, it was not able to protect real incomes from falling, since the depreciation that stabilized employment caused real wages to decline.

APPENDICES

DESCRIPTION OF THE SURVEYS

A. HOUSEHOLD EXPENDITURE AND INCOME SURVEY

This survey has been conellected since the 1960 and on a regular annual basis since the 1970s. The survey is stratified by rural and urban and by province. It reports on demographic characteristics, expenditures and income of about 38,000 households. The sample is divided into 12 equal monthly subsamples. Micro level data for these surveys are publicly available since 1984 on the website of the Statistical Center of Iran.

B. LABOR FORCE

The current Labor Force Survey of Iran is designed to conform to international standards, especially those of the ILO. It replaced an earlier, non-standard survey, Household Employment and Unemployment Characteristics Survey (HEUCS), which ended in 2004. The LFS has been collected on a rotational basis drawing on a basic sample from which subsamples are used in rotation. Households enter the survey in a given season, stay on for two seasons before exiting and returning on the same season a year later. Sample sizes are large, typically over 100,000 households (about 500,000 individuals).

Households can be matched based on information provided by the survey, but matching individuals is more complicated, because if a member of the household leaves, his or her individual number is given to the next household member. The paper matched most of the individuals on the basis of sex and age and dropped those observations which did not match with the same household and individual id number in a previous round.

ENDNOTES

M. Weisbrot and J. Sachs , “Economic sanctions as collective punishment: The case of Venezuela,” Center for Economic and Policy Research, pp. 1–25 (2019).

M.R. Farzanegan, M.M. Khabbazan and H. Sadeghi, Effects of Oil Sanctions on Iran’s Economy and Household Welfare: New Evidence from A CGE Model, pp. 185–211 (New York, 2016).

For a review, see D. Thomas and E. Frankenberg. “Household responses to the financial crisis in Indonesia: Longitudinal evidence on poverty, resources, and well-being,” in Globalization and Poverty, Ann Harriosn (ed.) pp. 517–560 (Chicago, 2007).

Nadereh Chamlou “Iran’s Economic Performance Since the 1979 Revolution,” The Atlantic Council, 2/1/2019, and Salehi-Isfahani, “Iran’s Economy 40 Years After the Revolution,” in Maloney, Suzanne, ed. The Iranian Revolution at Forty. Brookings Institution Press, 2020.

For more on this, see the paper by Kevan Harris in this series.

Salehi-Isfahani, “Rising Employment Casts Doubt on IMF’s Grim Forecast for Iran’s Economy,” Bourse and Bazaar, 10/30/2019.

Survey data on household consumption underestimate private consumption recorded in the national accounts of all countries, but in Iran the underestimation is larger because of enormous government subsidies, especially for energy (more on energy subsidies in Section II below). Since energy subsidies have grown over time, in tandem with economic growth and energy use, the underestimation has increased, creating a large gap between the trends in GDP per capita and consumption on the one hand and GDP in constant price and Purchasing Power parity dollars on the other.

For evidence of the latter see the companion paper in this project by Shahrokh Fardoust.

See the appendices for the data used in Figure 2 and the spatial weights that adjust for difference in cost of living as experienced by the poor.

K. Katzman, “Iran Sanctions,” Technical Report, Congressional Research Service (2020).

Shahi, A. (2019). Drought: The Achilles heel of the Islamic Republic of Iran. Asian Affairs 50 (1), 18–39.

12. Asadi, G. and M. H. Mostafavi-Dehzooei (2019). “The effects of precipitation shocks on rural labor markets and migration.” Available at SSRN 3249735.

13. Expenditures are deflated by the CPI for rural and urban areas and spatially adjusted using weights calculated from poverty lines for urban and rural areas of each province

14. “No Time to End Sanctions”, Wall Street Journal 3/25/2020. For an earlier statement of the same view, see also J. Amuzegar “Iran’s economy and the U.S. sanctions,” The Middle East Journal, 185–199, 1997.

15. The methodology proposed by Ravallion 1992; and implemented by Salehi-Isfahani and Hashemi (2007), Working Paper, Department of Economics, Virginia Tech.

16. The results obtained are broadly consistent with those in Salehi-Isfahani (2017), Poverty and income inequality in the Islamic Republic of Iran. Revue internationale des ́etudes du d ́eveloppement (1), 113–136; and a World Bank study which applied a similar method to estimate poverty rates for Iran (Atamanov, A., M.-H. Mostafavi, D. Salehi-Isfahani, and T. Vishwanath (2016). Constructing robust poverty trends in the islamic republic of iran: 2008–14. Technical report, Policy Research Working Paper 7836, The World Bank).

17. Salehi-Isfahani 2014. “The reform of energy subsidies in Iran: from promise to disappointment.” Economic Research Forum, Policy Perspective (13).

18. Table 12 in the appendices.

19. Poverty rates are the percentage of those with real per capita expenditures below the international poverty line of $5.50 for upper middle income countries. Real expenditures are deflated by rural and urban CPI’s provided by the SCI and spatially adjusted using weights derived from the poverty lines for the rural and urban areas of each

20. Banerjee and Duflo, 2008; Madland, 2011; Easterly, 2001.

21. Homi Kharas, How a Growing Global Middle Class Could Save the World’s Economy. Brookings Institution, July 5, 2016.

22. Banerjee and Duflo, op. cit., recommend twice the poverty line, about $11 PPP in per capita expenditures in Iran’s case; Birdsall (2015) uses $10 PPP as the middle class floor.

23. Salehi-Isfahani, 2016.

24. Pritchett and Spivack 2013. The poor generally spend upwards of 40 per cent of their income on food.

25. Salehi-Isfahani, “The Coronavirus Is Iran’s Perfect Storm,” Foreign Affairs, March 18, 2020.

26. Ibid.

27. Atamanov, Mostafavi, Salehi-Isfahani and Vishwanath 2016.

28. Salehi-Isfahani 2014.

29. Individuals in the lowest quintile who reported positive amounts under ”scholarships and other official transfers.” 2019 rials converted to USD PPP at the rate of 22,075 rials: $1 estimated by the World Bank.

30. Salehi-Isfahani, Belhaj-Hassine, and Assaad 2014; Assaad, Salehi-Isfahani, and Hendy.

31. Salehi-Isfahani, 1989.

32. Atkinson, Piketty, and Saez 2011.

33. The Gini and GE indices on the left axis, the 90/10 ratio on the right axis.

34. The table reports the estimated.

35. coefficients of the probit function, which indicate the direction of change but do not measure the probabilities of falling into poverty. The probabilities are calculated using these coefficients and the ”margins” command in STATA. To estimate these probabilities, the values of all other variables are set to their means or to other values as indicated by the context.

36. To save space, the coefficients for 31 provinces are not reported in the table.

36. See Table 19 in the appendices for the data behind this figure.

37. Number employed in each quarter.

38. Wages are deflated by CPI and adjusted for differences in living costs across provinces and rural and urban areas of all provinces.

39. Media reports of research done at Iran’s Parliament Research Center put the share of informal employment at 60 percent.

ABOUT THE AUTHOR

Djavad Salehi-Isfahani received his PhD in Economics from Harvard University and taught at the University of Pennsylvania (1977–1984) before joining the faculty at Virginia Tech, where he is currently Professor of Economics. He is a Non-resident Senior Fellow at the Global Economy and Development, the Brookings Institution, and a Research Fellow at the Economic Research Forum (ERF) in Cairo. He has held visiting positions at the University of Oxford (1991–1992), the Brookings Institution (2007–2008), and Harvard Kennedy School (2009–2010, and 2013, and 2016-2017). He has served on the Board of Trustees of the ERF, the Middle East Economic Association, the International Iranian Economic Association, and as Associate Editor of the Middle East Development Journal. His research has been in energy economics, demographic economics, and the economics of the Middle East. He has coauthored two books, Models of the Oil Market and After the Spring: Economic Transitions in the Arab World, and edited two books, Labor and Human Capital in the Middle East and The Production and Diffusion of Public Choice. His articles have appeared in the Economic Journal, the Journal of Development Economics, Health Economics, Economic Development and Cultural Change, the Journal of Economic Inequality, the International Journal of Middle East Studies, the Middle East Development Journal, and Iranian Studies, among others.

ACKNOWLEDGMENT

The author wishes to thank Ali Vaez for initiating and managing the project, and for comments Tarek Ghani, Hossein Samiei, two anonymous referees and participants in the webinar on Iran’s Economy Under Sanctions, SAIS, 17 October 2020.

The SAIS Initiative for Research on Contemporary Iran

Johns Hopkins University Washington, DC

Copyright 2020 All rights reserved