Civilian Pain Without a significant

political gain

HADI KAHALZADEH

TABLE OF CONTENTS

I. INTRODUCTION

II. US ECONOMIC SANCTIONS ON IRAN: AN OVERVIEW

III. THE MACROECONOMIC SHOCKS, SANCTIONS, AND SOCIAL WELFARE

IV. PRICE SHOCK AND HOUSEHOLDS’ CONCEPTION PATTERN UNDER SANCTIONS

V. EXCLUSIVE SOCIAL WELFARE PROGRAMS

VI. LABOR MARKET IMPACT OF THE SANCTIONS

VII. POVERTY DISTRIBUTION

VIII. IRAN’S SOCIAL WELFARE SYSTEM, A FAILED BUREAUCRATIC OVERSUPPLY SYSTEM

IX. CONCLUSION

I. Introduction

Over the past four decades, economic sanctions have been a prominent feature of US-Iran policy. The United States has orchestrated and imposed numerous unilateral and multilateral sanctions to isolate and rally support against the Islamic Republic. The underlying premise of economic sanctions is that foreign economic pressure, by its inherent transformative power, would create political pressure within the target country and induce the government to comply with the demands of sanctioned foreign powers.[1] The argument posits that economic hardship would simultaneously exacerbate citizens’ social welfare and limit the state’s resources. A combination of moral responsibility to its people and budget pressure could alter target state decision-makers cost-benefit analysis, ultimately resulting in political compliance. If not, economic warfare would fuel political dissatisfaction and paralyze governance, eventually leading to compliance.[2] From this perspective, economic sanctions are viewed as effective instruments of coercive statecraft for achieving “political gain” by inflicting “civilian pain” without resorting to military force.

Upon closer examination of the case of Iran, it reveals that despite significant economic distress experienced by the Iranian people and government, sanctions have failed to exert sufficient domestic political pressure on the Islamic Republic to comply with US demands, particularly since the imposition of “maximum pressure” sanctions in 2018. While factors such as the disproportionality of sanctions with their objectives and the types of sanctions employed have contributed to this outcome, Iran’s social welfare system has played a crucial role in hampering sanctions effectiveness since 2018. The social welfare system, by distributing the burden of sanctions unevenly, disproportionately affecting vulnerable populations, and bolstering the ruling bloc’s resilience, hindered the effectiveness of sanctions in generating effective political pressure for compliance with foreign demands. These economic sanctions shrank Iran’s economy, increased economic stagflation, caused surging unemployment and inflation, deteriorated accessibility, affordability, and quality of health services, and pushed many Iranians below the poverty line.[3] However, the economic sanctions have not brought the Islamic Republic to its knees, nor have they provoked the Iranian people to rise up against it, as was expected under the maximum pressure policy.

This study argues that the economic pain of sanctions failed to translate into effective domestic political pressure, particularly within the Iranian decision-making system, because the welfare system provides high levels of protection to groups with high political influence. Owing to Iran’s privilege-based welfare system, most influential segments of society, including but not limited to public employees – who have the power to influence politics and policies or operate the state functions and provide governance services – have been more protected and experienced less adverse impacts from sanctions than other segments of Iranian society. In contrast, a large segment of society with lower formal political influence has been more adversely affected. Because the impacts of sanctions are unequally distributed across the population, the economic pain of the sanctions is primarily experienced by those who have less influence on the policies of the Islamic Republic. A large public sector with parallel welfare institutions and diverse benefits programs provides higher protection to public servants and formal sector employees than needy and vulnerable populations. Public employees, such as military personnel, bureaucrats, and other societal groups that influence the Islamic Republic policies, enjoy enormous insulation against economic shocks. However, needy and vulnerable populations with lower political influence receive only residual welfare benefits. Hence, the privilege-based welfare system plays a significant role in preventing foreign economic pressure from being translated into internal frustration and effective domestic pressure for any compliance.

In support of this argument, this study examines Iranian households’ consumption patterns and coping strategies to determine their economic vulnerability and capacity to respond to economic shocks. To define economic vulnerability, this paper focuses primarily on material deprivation and vulnerability to poverty. Using the Iran Household Expenditure and Income Survey (HEIS) data from 2010 to 2020, the study reviews Iranian households’ coping strategies and consumption patterns, indicating that sanctions have unevenly impacted Iranian households between 2010 and 2020. Although all Iranians were adversely affected by the sanctions and contracted their real expenditures on education, health, transportation, and entertainment to meet the resulting rising housing costs, public employees suffered fewer welfare losses than workers in the informal sector. However, the capacity to withstand economic shocks varies among different segments of Iran’s society. Public employees with political influence who maintain the state’s functions are less affected by economic sanctions than informal workers with low political influence who are more adversely affected. It is worth mentioning that this study utilizes the concept of the “ruling bloc” as posited by Jones (2015)[4], to structure the argument. In his approach to social conflict analysis of sanctions, Jones critically examines the impact of economic sanctions on the ruling bloc or ruling coalition within targeted nations. [5]

Ii. US ECONOMIC SANCTIONS ON IRAN: AN OVERVIEW

The US sanctions on Iran’s economy can be classified into three stages based on the severity of their economic costs. The first episode began in 1979 and lasted until 2010. Following the Iranian hostage crisis in November 1979, the United States cut its diplomatic relations with Iran, froze nearly all Iranian assets held on its territory, and imposed sanctions on Iranian oil and trade. Later and in the mid-2000s, US sanctions focused primarily on Iran’s nuclear program and military capabilities. During the first episode, Iran was excluded from the US banking and energy sectors but not from the international market. As a result, the Iranian economy suffered more from missed opportunities than from incurring significant costs. According to some estimates, sanctions between 1979 and 2000 cost Iran’s economy between 1.1 and 3.6 percent of its GDP in 2000.[6]

The second phase of Iranian sanctions was initiated following a breakdown in negotiations between Iran and the P5+1 (the five permanent members of the UN Security Council plus Germany) in Geneva in 2009. The US orchestrated the UN Security Council Resolution 1929 in June 2010 and enacted the Comprehensive Iran Sanctions, Accountability, and Divestment Act (CISADA) in July 2010. President Obama extended secondary sanctions to Iran’s Central Bank and the oil sector in December 2011. In contrast to the primary sanctions imposed in the first episode, which prohibited US companies from doing business with Iran, the secondary sanctions penalized foreign citizens and entities for doing business with Iran. The European Union (EU) joined the US’s sanctions on Iran’s oil industry in January 2012 and terminated Iran’s access to the Society for Worldwide Interbank Financial Telecommunication (SWIFT) – the global messaging system for banking transfers. Between 2012 and 2013, Iran’s economy contracted by 17 to 20%, and crude oil exports decreased by as much as 50%.[7,8] This round of sanctions remained in effect until the 2015 nuclear deal, when Iran agreed to constrain its nuclear program in exchange for sanctions relief.

The third episode of sanctions started on 8 May 2018, when President Trump officially ceased US participation in the Joint Comprehensive Plan of Action (JCPOA) and imposed new sanctions on Iran. While all suspended sanctions under JCPOA are reimposed, the Trump administration imposed an unprecedented new round of sanctions on Iran. Over the course of the maximum pressure policy, the sanctions cases tripled. In 2018 and 2019, Iran's oil exports dropped 80 % from 2.5 million barrels per day (mbd) to under 0.3 mbd, which in turn contracted oil income from $42.2 billion in 2018 to just $13.75 bn in 2019.[9] While Iran's foreign reserves after the JCPOA stood at $115 billion in 2017, by 2019, sanctions had shrunk these reserves to $85 billion. This phase of sanctions coincided with the Coronavirus outbreak that exacerbated the social and economic impacts of the sanctions.

The primary objective of Obama’s policy was to eliminate or slow Iran’s nuclear capability. In contrast, the stated objective of Trump’s policy was to force Iran back to the bargaining table to re-negotiate the JCPOA with even stricter restrictions on its nuclear and missile programs. In their unstated intentions, senior Trump officials such as Secretary of State Mike Pompeo and National Security Advisor John Bolton attempted to provoke the Iranian people to rebel against the Islamic Republic by imposing harsher economic sanctions.[10]

In terms of humanitarian impact, the secondary economic sanctions since 2011 strained Iranian social welfare, crippled Iran’s middle class, pushed a significant segment of society into poverty, and undermined access to the basic necessities of life, including nutritious food, medical care, and medicines. Not surprisingly, the most disadvantaged segments of society suffered more than others. [11]

Iii. THE MACROECONOMIC SHOCKS, SANCTIONS, AND SOCIAL WELFARE

Generally, macroeconomic shocks such as economic sanctions alter households’ welfare through two main transmission channels: labor market and price shocks. Households during the macroeconomic shocks are more likely to suffer from layoffs, reduced working hours, and low earnings, all of which threaten their primary source of income. At the same time, inflation increases households’ expenditures and erodes their real income value, reducing their purchasing power. Households adopt different types of coping strategies to deal with their budget deficit and their weakened purchasing power. They may adopt behavior-based strategies such as smoothing consumption patterns, seeking additional employment, or migrating. Households may opt for asset-based strategies such as using savings, selling assets, or taking out a loan. Alternatively, they may seek informal and formal assistance from their community or network and follow assistance-based strategies.[12] Obviously, these coping strategies are highly dependent upon households’ sociodemographic characteristics, economic characteristics, and the social safety net available to them.

In Iran’s case, the inflation and unemployment effects have not been equally felt across all segments of society. For instance, employees in the informal sector have been at a greater risk of losing their jobs or other sources of income, while formal workers, owing to Iran’s labor law, are less likely to be exposed to this risk. Such a risk is almost nonexistent in the public sector. Likewise, high inflation tends to affect households with low and middle incomes more than households with greater wealth.[13] Because 55 to 60 percent of informal employees can be considered poor or vulnerable to poverty in Iran households headed by informal employees are the most harmed by price shocks. As inflation erodes the value of real wages and savings of the poor and vulnerable populations, including those in the informal sector and those without jobs, it raises the value of properties and assets owned by wealthy families.

Using Iran's HIES data, this study explores the consumption patterns of Iranian households in response to the economic hardship posed by sanctions to prove if social protection is highly correlated with social and political influence. To do so, the study examines the consumption patterns adopted by government employees and employees affiliated with the Iranian Social Security Organization (SSO) and households headed by informal sector employees or by the unemployed.

The formal sector employees are primarily public and private sector employees affiliated with the SSO. According to Iranian labor law, all formal employees in the private sector are required to register with the SSO, a public and social insurance organization. Employers are responsible for paying 30 percent of the salary as SSO premiums, of which 23 percent is the employer’s share, and seven percent is the employees’ share. However, Iran’s labor statistics regarding the share of informal and formal labor markets are contradictory. According to the Labor Force Survey (LFS) administrated by the Iran Statistical Center, 42 percent of Iran’s labor force (9.7 out of 23.2 million) is employed in the formal sector, and 58 percent (13.5 out of 23.2 million) in the informal sector in 2021. Nevertheless, other official statistics indicate that 75 percent of the labor force comprises workers in the formal sector, including four million public employees and 14 million SSO members (18 million out of 24 million). Using weighted HIES data, the study found that 40 percent of employees were employed in the formal sector (public sector and affiliated with the SSO), which is very similar to the percentages cited in the LFS records.

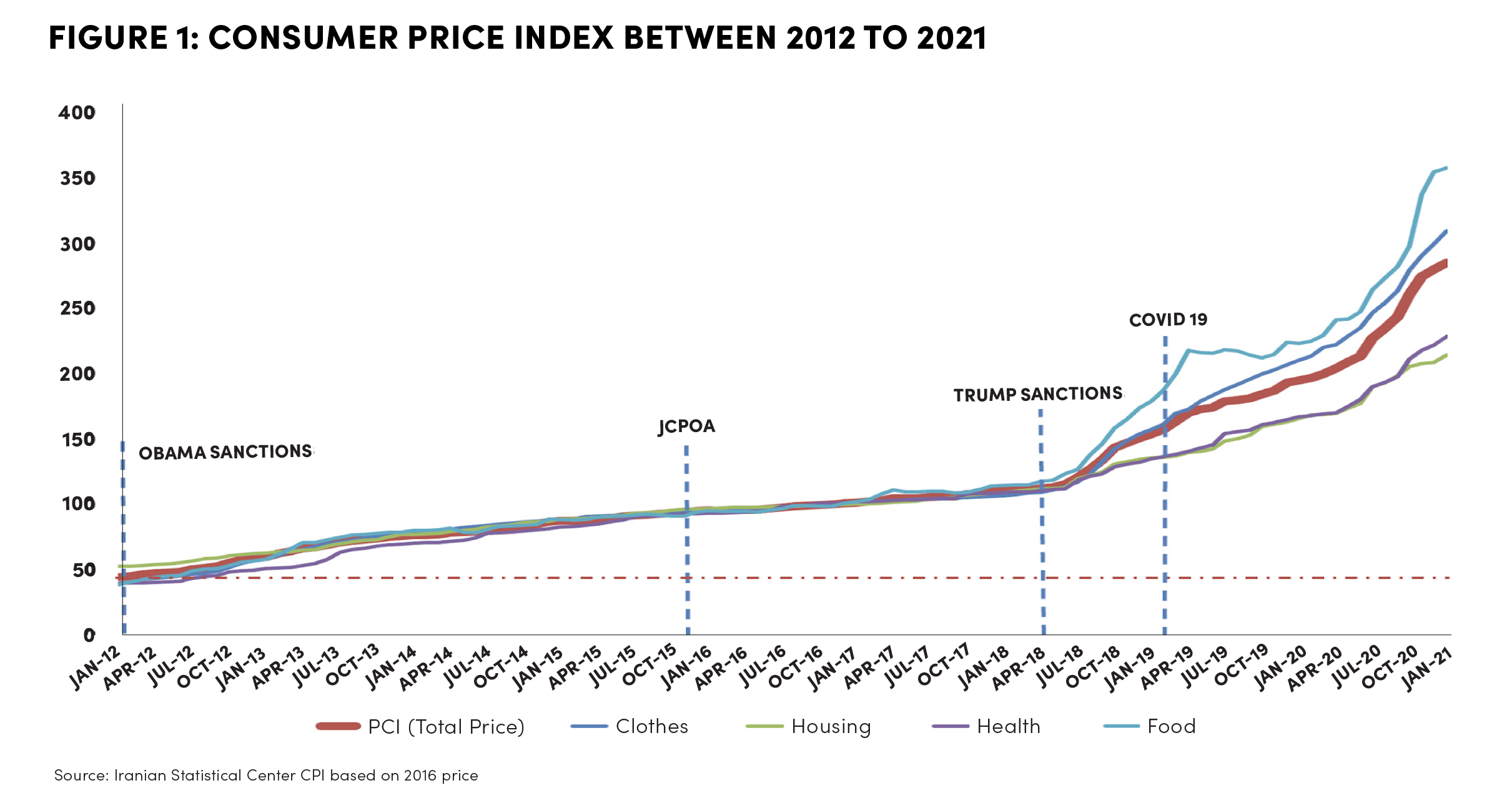

IV. PRICE SHOCK AND HOUSEHOLDS’ CONCEPTION PATTERN UNDER SANCTIONS

As discussed above, inflation is the key transmission channel through which economic sanctions alter the social welfare of Iranian households. According to Iran’s consumer price index estimated by Iran Statistics Center (ISC), the general price level rose by 1,080 percent from March 2011 to March 2021 (the first month of the Iranian year 1390 to 1400). Economic sanctions have contributed to inflation and have decreased Iran’s oil income and restricted access to foreign reserves, leading to budget deficits and a shortage of hard currency. Iran primarily tackles its public budget deficits through expansionary monetary policies and by printing money, rather than instituting fiscal policies, which leads to an increase in liquidity. The sanctions also intensify inflation expectations and speculative demand for hard currency. Consequently, the sanctions have resulted in a rise in general price levels due to the printing of more money, an increase in inflation expectations, and a devaluation of the national currency.

Higher inflation declines households’ real purchasing power and leads to a deeper household deficit. A review of the annual Household Income and Expenditure Summaries published by the ISC shows that the real median household income for rural and urban households decreased by 10.7 percent and 13.4 percent, respectively, during the first two years of the Obama sanctions between 2011 and 2013. Accordingly, the real median household income in Iranian cities and rural areas decreased by 25.7 percent and 23.9 percent, respectively, in 2020 compared to 2017.

Throughout this ten-year period there have been varying degrees of welfare contraction among urban and rural areas and households headed by formal and informal workers. From an expenditure perspective, HIES indicates that the real value of household expenditures at the national level, urban residences, and rural residences fell by 21, 19, and 36 percent, respectively, in 2020 compared to 2011. During the ten-year period from 2011 to 2020, Iran experienced two economic sanctions periods that were interrupted by a breathing period of the Iran Deal. Between 2011 and 2013, real household expenditures decreased by eight percent in urban areas and 14 percent in rural areas, respectively. During the period the JCPOA was in effect, the real household expenditures for urban residents increased significantly. In comparison with 2017, real household expenditures in 2020 decreased by 18.5 percent and 21 percent in urban and rural areas respectively.

There have also been differences in the contraction of household welfare between households headed by formal and informal workers. The real expenditures of households headed by public employees and members of the SSO remained two and 1.5 times higher than those of informal workers and the unemployed respectively. While formal sector workers’ households experienced a 17 percent decline in their real expenditures, informal sector workers’ households saw a 29 percent decline in their real expenditures between 2011 to 2020.

A detailed analysis of the household consumption basket indicates that Iranian families have decreased their real food expenditures and food share of total expenditures. The real value of food expenditures in all Iranian households declined by 42 percent in 2020 compared with 2011. Between 2011 and 2020, the share of food spending in household budgets decreased from 35.5 percent in 2011, to 26.3 percent in 2020. An Iranian government study conducted by the Ministry of Cooperatives, Labor, and Social Welfare, found that Iranian monthly consumption of red meat, milk, and rice per individual decreased respectively by 51.6 percent, 35.3 percent, and 34.7 percent between 2011 and 2019.[14] However, similar to the trend observed in overall contraction of welfare, this contraction in real food spending has varied among households headed by formal and informal workers. For instance, public workers decreased their real food spending by 38 percent between 2011 to 2020, whereas households headed by informal workers decreased their spending by 43 percent over the same time period. From 2011 to 2020, the share of food consumed by households headed by public workers and SSOs declined from 27 percent to 20 percent and 29 percent to 21 percent, respectively. However, unemployed and informal sector workers declined the share of food in their expenditures from 34 percent in 2011 to 27 percent in 2020. Of course, such a reduction in household food consumption cannot be interpreted as improving the family’s welfare. Because over the course of the JCPOA, when households’ welfare improved, public workers and SSO members increased their food spending. Despite such improvement, real food expenditures in 2020 contracted by 22 percent compared with 2017 for all three groups. The share of food in the consumption basket of public employees was on average 10 percent lower than that of informal sector workers, 22 percent compared to 32 percent between 2011 and 2020.

The trend of informal worker-headed households having to contract their expenses more significantly than formal sector workers can be found in other household expenses, such as education and entertainment. Between 2011 and 2020, real education spending in households headed by public workers, SSO members, and informal sector employees declined by 32 percent, 49 percent and 53 percent respectively. Similarly, despite the low share of entertainment spending among families – less than two percent of household expenditures– public workers, SSO members, and informal sector employees reduced their real entertainment spending by 39, 60, and 66 percent during the same period.

In terms of health spending at the national level, Iranian households reduced their real health expenditures by eight percent between 2011 and 2020. These health expenditures among public sector employees and informal sector employees ranged from five and nine percent, respectively, in 2020, compared with 2011. However, during the implementation of the JCPOA, the overall spending on health increased by 17.3 percent for all Iranian households. Public sector employees, SSO members, and informal sector employees increased their health expenditures by 32 percent, 29 percent, and nine percent, respectively. However, during Trump’s sanctions and even in the first year of the outbreak of the Coronavirus pandemic, households headed by public employees, SSO members, and informal sector employees experienced a decline in real health expenditures of 10 percent, 11, and 13 percent, respectively, in 2020 in comparison with 2017. These figures reveal that Iranian households had to forgo and reduce their spending on essential items like healthcare during periods of heightened sanctions, suggesting that during times of increased economic pressure, Iranians had to prioritize their expenses and potentially compromise on their health expenditures.

It is worth mentioning that Iran’s government and the SSO are responsible for providing health insurance and retirement, as well as disability benefits to their members and their families. One hundred percent of the public employees and SSO members were covered by health insurance in 2020. In contrast, 81 percent of informal workers, on average, were covered by health insurance between 2011 to and 2020. Despite the expansion of health insurance, all three of these groups were responsible for part of their health expenditures.

A detailed analysis of the HIES indicates that informal workers and unemployed households experience health impoverishment at rates four times greater than public employees. Health impoverishment occurs when a non-poor household falls into poverty as a result of out-of-pocket healthcare expenses. On average, three percent of Iranian households every year fell into poverty due to health expenditures between 2011 and 2020. However, the health impoverishment rate for public workers has been one percent per year, whereas it has been four percent annually for families headed by informal workers who fell below the poverty line as a result of their medical expenses. The data shows that households decreased their health expenditures to cope with the economic shock of the sanctions, even in the first year of the pandemic. In contrast, they increased their health expenditures during the JCPOA period. Taken together, this suggests that during economic shocks, Iranians have to cut back on their healthcare spending, and informal workers are especially vulnerable to this trend, as they face a higher risk of falling into poverty due to healthcare-related expenses.

The change in the household consumption basket over the course of two stages of sanctions show that Iranian households, despite a 21 percent reduction in their consumption, had to spend more on housing. In 2011, housing costs represented 26.3 percent of the Iranian household’s consumption basket, but by 2020, housing costs had increased significantly to 43.3 percent nationally. Turning again to specific household categories, public workers, members of SSO, and the informal sector spent five percent, 15 percent, and 22 percent more on housing in 2020 as compared to 2017.

V. EXCLUSIVE SOCIAL welfare programs

Besides the national social welfare programs available to public employees, many governmental institutions and programs provide exclusive social welfare benefits to enhance public employees’ economic security. Almost all government agencies have their own welfare service centers which provide subsidized loans, health care services, food items, entertainment, recreational accommodations, and lodging to their members. For instance, under certain benefit programs, a public servant could be eligible to use recreational accommodation and lodging across the country with her/his family. While the use of such free or highly subsidized recreational lodging varies among the government agencies, military and intelligence families tend to take advantage of recreational lodging benefits once or twice a year. Many public employees receive subsidized food items as part of their compensation occasionally and frequently.

Almost all government agencies in Iran have established Employees Consumer Cooperatives, which are retail stores operated cooperatively by agency employees to meet the needs of their fellow employees. In Tehran alone, over 400 small and large retail stores offer livelihood services to government workers. At such retail stores, consumer cooperatives offer a wide range of food, non-food items and durable commodities at reasonable prices to their members. The National Union of Government Employees Consumer Cooperatives, known as SKAD, encompasses over 330 consumer cooperatives and is one of the largest cooperatives in the country. Another advantage of Consumer Cooperatives is that they allow public workers to pay for their purchases in installments. In an unstable economy, where inflation is high and the currency is continuously devalued, it is advantageous for public workers to purchase what they need and pay for it over time. Legislation also mandates the provision of particular welfare benefits to state employees. For example, according to the Welfare Facilities for Public Employees Act, the Ministry of Industry, Mines and Trade is obliged to provide the basic and necessary goods needed by government employees through the Employees Consumer Cooperatives of each of the related executive bodies. Similarly, Iranian banks are obliged to provide 20 percent of their total good loan resources to public employees as emergency loans.

Another example of significant public employee benefits are the welfare programs of the Cooperative Foundations (Bonyad Ta’avon), which are the economic arms of Iran’s military and security institutions. According to their articles of association, the Foundations aim to provide subsidized loans, mortgages, business loans, subsidized land, and construction materials to their personnel. Through their Cooperative Foundations, the Islamic Republic of Army Forces, the Iran Police Forces, the Islamic Revolutionary Guards Corps (IRGC), the Ministry of Defense and Armed Forces Logistics, and the Basij Resistance Force affiliated with IRGC, are all heavily engaging in economic, banking and trade activities and providing welfare support to their members. While the Cooperative Foundations might not be formally considered to be part of the Iranian welfare system, they have improved the economic security of public sector employees, particularly military personnel, and have also arguably influenced Iranian social policies. In other words, given their prominent role as key stakeholders in Iran’s economy, Cooperative Foundations exert considerable influence over social policies related to critical sectors such as housing, medicine, and healthcare.

These exclusive social programs and institutions allow public workers families to adopt both behavior-based and asset-based coping strategies under economic shocks, which in turn enhance their economic security. Of course, the sanctions may have gradually eroded the government’s capacity to maintain the real purchasing power of its employees and the value of such non-cash compensation and subsidies due to the country’s sizable budget deficit and high inflation. Nonetheless, these forms of assistance remain crucial in supporting public sector employees. However, it is important to acknowledge that non-public employees do not have access to such forms of support. Considering the reality that public sector employees are not at risk of losing their jobs under the sanctions and enjoy a constant and higher level of income, they receive exclusive non-cash compensation and bonuses which insulates them from external economic shocks. Welfare centers and cooperatives assist them in managing their expenditures and protecting a portion of their welfare, even under high inflation. However, a significant proportion of the Iranian labor force, including informal workers and many formal workers in the private sector, are not entitled to receive such exclusive social and economic assistance, making them highly susceptible to the risk of unemployment and the loss of their primary source of income.

VI. LABOR MARKET IMPACT OF THE SANCTIONS

Given the negative impact of the sanctions on overall economic growth, it is anticipated that sanctions increase the risk of layoffs, reduce working hours, or lower salaries for working people in Iran. According to the ISC, the number of people employed in Iran increased from 20.4 million in 2011 to 22.9 million in 2020. However, prior to Trump’s sanctions and the COVID-19 pandemic in 2019, Iran had a workforce of 24.4 million – meaning that more than 1.5 million jobs have been lost as a result of the outbreak of COVID-19 in Iran. A recent study indicated that Iran’s employment rate has systematically decreased after the economic sanctions over the last thirty years – in particular, female labor force participation saw significant declines during the sanctions.[15]

Similarly to inflation, the adverse impact of sanctions on the labor market is not evenly distributed. The risk of losing a job in the public sector is almost zero, and it is impossible for the government to fire employees solely because of economic hardship. For instance, none of the 1.5 million jobs lost during the pandemic were in the public sector. Iranian formal workers enjoy a high level of protection owing to Iran’s labor law. In contrast, workers in the informal sector have been at greater risk of losing their jobs because of the lack of protection. Therefore, the entire adverse impact of the sanctions on the labor market has been borne by the informal sector, particularly female workers.

By applying an employee-friendly labor law, the welfare system also protects formal sector workers in the private sector, making it difficult for private sector employers to lay off their workers. Even if a formal employee is laid off, unemployment insurance offers 55 percent of her/his salary for a maximum period of 36 months for single employees and 50 months for married employees. Despite the existence of such generous social protection measures against unemployment, these benefits are not granted to all unemployed Iranians, and only 8.6 percent of unemployed workers receive such benefits. In other words, in the last decade, only 8.6 percent of Iran’s unemployed population was eligible for unemployment benefits, and unemployment insurance benefits were paid out for 19 months on average to eligible unemployed individuals.[16] This unemployment protection program mainly targeted formal employees with a permanent contract. Formal sector labor with fixed-term contracts had to have worked for their employers for more than one year to be eligible for such insurance. This means that nearly 40 percent of Iran’s formal sector employees are deprived of receiving unemployment benefits owing to their contracts.[17] Most of these fixed-term contracts are offered to low-skilled workers in the formal sector or those without the leverage to negotiate for permanent employment. Therefore, while Iran’s social welfare system provides a high degree of protection to public employees against the adverse impacts of sanctions on the labor market, a substantial portion of Iran’s labor force, especially informal workers and those with fixed or non-permanent contracts in the formal sector, lack the safety net of unemployment benefits and thus bear a disproportionate burden imposed by such shocks.

VII. POVERTY DISTRIBUTION

Using the Cost of Basic Needs (CBN) method to measure poverty, the results indicate that households headed by informal workers are five times poorer than households headed by public employees. Over the period of 2011 to 2020, six percent of public worker families lived below the poverty line, while 32 percent of informal worker households lived in poverty. While public employees’ poverty rate remained between five and six percent during the Obama sanctions, the poverty rate for employees in the informal sector increased during the same period from 26.6 percent in 2011 to 31 percent in 2014. After Trump’s sanctions, poverty rates rose among both public employees and informal sector workers. For public workers, poverty rates increased from four percent in 2017 to ten percent in 2020, and for informal workers poverty rates increased from 32 percent to 40 percent. In terms of national-level poverty, the study results indicate that the average poverty rate at the national level remained at 22 percent during the Obama sanctions, and this average rate reached 29 percent during the Trump sanctions. From 2011 to 2014, the poverty rate increased to 25 percent, and from 2017 to 2020, the poverty rate increased to 32 percent.

It is worth mentioning that the study categorizes households into four economic classes based on their expenditures. A household is classified as poor if its expenditures fall below the poverty line established by the study, while a household spending more than the poverty line but less than 150 percent of the poverty line is considered vulnerable. The middle class is defined as households with expenditures between 150 percent and 500 percent of the poverty line, and households with expenditures exceeding 500 percent of the poverty line are considered upper-middle-class.

In the period 2010-2020, more than 70 percent of public workers were placed in the middle class, while only 39 percent of households headed by informal workers qualify as middle-class households. Regarding vulnerability to poverty, on average, 18 percent of households headed by public employees were considered vulnerable during this period, compared with 26 percent of informal workers and unemployed families who were not poor but were at risk of poverty.

VIII. IRAN’S SOCIAL WELFARE SYSTEM, A FAILED BUREAUCRATIC OVERSUPPLY SYSTEM

The social welfare system is among the instruments used by targeted states to manage the risks associated with economic sanctions. In this regard, comprehending Iran’s social welfare system is crucial in understanding the potential alterations to citizens’ social welfare under sanctions, the distribution of possible adverse effects of sanctions, and the likelihood of these impacts intensifying among specific segments of the population. Additionally, this understanding offers valuable insights into how the political system prioritizes its protection and support, and how different segments of society respond to macroeconomic shocks based on their access to social protection.

The Islamic Republic social welfare system comprises a significant number of governmental and para-governmental institutions that deliver extensive welfare programs to Iranian citizens. However, examining the demand and supply sides of the social welfare system indicates that this system of oversupply is more privilege-based than need-based. An investigation into the consumption patterns of households led by formal and informal sector workers, and the interpretation of such patterns as a behavior-based coping strategy, has revealed the significant bias in the social welfare system in favor of formal sector employees, particularly those with substantial influence on domestic politics. For instance, military personnel, security forces, and militia forces linked to the IRGC, and affiliated factions working in the public and private sectors, constitute a ruling bloc. This bloc also includes middle-level public servants or high-ranking bureaucrats appointed based on loyalty rather than merit. The ruling bloc wields significant influence over the Islamic Republic’s policies, and their priorities are given a high level of consideration by those in power. The Islamic Republic often seeks to satisfy their needs and offers them certain welfare privileges, particularly under security threats like foreign economic warfare. In this sense, the social welfare system in Iran is highly politicized, and those who hold political power often benefit the most from government support. This preferential treatment of politically influential groups reinforces the elitist nature of the welfare system, where the needs of the few are prioritized over the needs of the many. Therefore, it is unsurprising that the adverse effects of economic sanctions in Iran have been felt more acutely by individuals and groups with less access to political power and influence.

Iran’s social welfare system appears to become a privilege-based system rather than a rights-based or a needs-based system. Although there have been multiple attempts to improve the social safety net in Iran since the 1979 revolution, the government has failed to establish a universal, sustainable, and equitable welfare system that addresses the basic needs of the most vulnerable populations and promotes economic security.

Historically, the Islamic Republic inherited an urban-biased social welfare system that aided formal workers in both the public and private sectors. After the 1979 Iranian Revolution, Iran’s social policy shifted towards a more inclusive and balanced rural.[18,19] The Islamic Republic’s constitution requires the government to provide all citizens with universal education, health care, employment, housing, and social services. The ideas of social justice and economic security set forth in the constitution were pursued through the formation of new revolutionary organizations and the implementation of new housing, educational, and health policies. These new policies and relatively steady economic growth, particularly after the Iraq-Iran war, resulted in a reduction of poverty and inequality, as well as development of human capital. In the middle of the 2000s, the Comprehensive Welfare and Social Security Organizational Structure Law, the formation of the Ministry of Welfare, and the implementation of a number of social programs, including the development of rural insurance, raised the prospect of restructuring a more inclusive welfare system. With oil revenues surging, Iran implemented a number of inclusive social programs, including two unconditional cash transfer programs, an affordable housing program, a universal health care program, and a program called “Justice shares” which was a scheme to distribute state-owned companies’ shares. Despite all efforts made to improve Iran’s social welfare, Iran’s government failed to construct a universal system to meet the basic needs of the most vulnerable populations and to enhance economic resistance against the adverse impacts of macrocosmic shocks such as economic sanctions.

There were a number of factors contributing to this failure, including insufficient state resources, inadequate information, the existence of multiple decision-making centers, and particularly, conflicts of interest within Iran’s political system. As an example, Ahmadinejad’s cash transfer program in 2011 likely mitigated the adverse effects of Obama’s sanctions in 2012 and 2013. Under the first-ever universal basic income program in Iran, Ahmadinejad’s administration provided $45 per person per month (445,000 Rial, which was equal to 25 percent of the median income in 2011) to 97 percent of the population.[20] Later, in 2019, Rouhani’s Livelihood Support Allowance program provided cash assistance (3 to 4 million rials) to 60 percent of the Iranian population. Currently, these two cash transfer programs, with the real monthly value of less than $8 per person, consume 12-13 percent of Iran’s public budget. Ultimately the government was unable to maintain the real value of its cash transfers owing to a large public budget deficit and a high inflation rate resulting from the recent sanctions.

The health system transformation plan implemented by Rouhani’s administration suffered the same fate. In 2014, the country launched a generous health insurance scheme so-called Rouhani Care or the Health Transformation Plan (HTP), to provide medical insurance to all Iranians. The program aimed to reduce Iran’s high out-of-pocket health spending by providing health insurance to all Iranians. Although the program increased health insurance coverage, it failed to meet its stated objectives, particularly due to the lack of adequate state resources and funds.

The lack of comprehensive data infrastructure and general mismanagement contributed to the failure of the social system to provide inclusive social protection. The Imam Khomeini Relief Foundation and the State Welfare Organization are two parallel institutions responsible for identifying and providing social protection to vulnerable populations in Iran. According to an unpublished study conducted by the Ministry of Cooperatives, Labor, and Social Welfare (MCLSW) in 2017, between 70 to 80 percent of Iran’s poor population (the first three income deciles) are not covered by these two parallel institutions. In contrast, these two organizations provide social assistance, including cash transfers and health insurance, to the wealthy income deciles. The “Maskan-e-Mehr” program is another example of a failed effort to provide effective and inclusive social protection to Iranians. In 2008, Ahmadinejad’s administration announced an ambitious plan to deliver 1.5 million residential units of land each year to low-income and vulnerable populations. However, during 14 years of the program, only two million residential units have been delivered. Low-income and vulnerable populations in the first three deciles, who were the intended beneficiaries of this program, could not benefit from it and sold their rights to wealthy deciles.[21] Although Rouhani’s administration attempted to develop a comprehensive statistical system to identify needy individuals and establish the Iranian Welfare Information Bank, the sustainability of such a national data bank within the current administration (2021- 2025) is in question.

Another factor contributing to the failure of Iran’s social welfare programs is the existence of parallel institutions and the multiplicity of decision-making centers. The multiplicity of decision-making centers in social policymaking has undermined coordination, cooperation, and commitment within the social welfare system. While the MCLSW is responsible for identifying vulnerable populations, implementing policies to eliminate poverty, and providing social assistance, the Imam Khomeini Relief Foundation, which has similar aims, is independent of the MCLSW and affiliated with the Supreme Leader’s office. In parallel, the Targeted Subsidies Organization, which is affiliated with the Management and Planning Organization of Iran (MPO), is assigned to identify vulnerable populations and distribute two unconditional cash transfers to them. Iran’s housing policies are another example of ineffective policymaking determined by many parallel institutions with different agendas and competing interests. More than 11 parallel institutions provide housing benefits, services, facilities, and subsidies, but more than 80 percent of their budgets are spent on overhead costs.[22] In the area of health policy, the presence of multiple stakeholders with diverse priorities and a lack of coordination impeded the development of an effective health insurance benefit package within Iran’s welfare system.[23,24] Notably, the Khatami administration attempted to centralize social policymaking and coordinate with parallel welfare institutions by establishing the Ministry of Welfare in 2003. His administration supported passing the Iran Comprehensive Welfare and Social Security Law. However, he failed to bring all of the parallel welfare institutions under his Ministry of Welfare. The Ministry of Welfare dissolved after a year of operation, suffering the same fate as the Shah’s Ministry of Welfare in 1975.

The lack of coordination, the absence of comprehensive data infrastructure, mismanagement, and conflict of interests among paralleled welfare institutions formed a bureaucratic oversupply or privilege-based welfare system in Iran. Tajmazinani characterized the Iranian welfare system as a unique “bureaucratic oversupply” in which “many governmental welfare institutions are paralleled with para-governmental institutions and bonyads with overlapping agendas”.[25] In essence, the bureaucratic oversupply or privilege-based welfare system has resulted in creating a multi-tiered welfare system that primarily benefits the interests of the ruling bloc rather than a need-based system that provides a universal social safety net. Under such a privilege-based system, the ruling bloc has the privilege of accessing both public programs and exclusive safety nets provided by the state and parallel para-governmental welfare institutions, while the less privileged segments of the population depend solely on official public programs. The accessibility, quality, and quantity of these public programs is directly linked to the government’s ability to access the oil windfall wealth. The economic sanctions cut such access to the oil income and undermined the government’s ability to maintain the value of its public welfare programs owing to budget deficit and high inflation. As a result, the ruling bloc enjoys its multi-tiered welfare system, but underprivileged segments of Iranian society including informal employees and unemployed population are left without an adequate and sufficient social support. Consequently, it is not surprising that such a privilege-based welfare system contributes to unequal distribution and made economic sanctions even more detrimental to marginalized groups.

IX. CONCLUSION

The effectiveness of economic sanctions highly depends on the conversion of foreign economic hardship into effective domestic political pressure. Iran’s experience indicates that the foreign economic pressure created by sanctions failed to generate domestic political pressure owing in part to the unequal distribution of the sanctions’ adverse impacts upon different segments of Iranian society. Among a number of factors, this study highlighted the role of the social welfare system in enhancing resilience to economic sanctions within the ruling bloc.

Iran’s privilege-based welfare system provides greater support for Iran’s formal sector employees, particularly public employees. Government employees, including military personnel and bureaucrats, and others who deliver governmental services and influence Islamic Republic policies, are well-protected against economic shocks. In contrast, the social welfare system fails to enhance the economic security of vulnerable Iranian populations. As such, a significant portion of Iran’s population, particularly those with limited political influence, receive only residual welfare benefits. In other words, the government’s ability to finance its general welfare program, which benefits the lower socioeconomic strata, is contingent on the availability of adequate oil revenues. In the event of a shortfall in oil income, the impact of macroeconomic shocks would be most acutely felt by these vulnerable segments of society. As a consequence, the economic pain caused by sanctions is not converted into effective domestic political pressure because those who can change policies in Tehran receive greater social protections, making them more resistant to the effects of sanctions. However, the most significant burden of sanctions falls on a large segment of the population who have almost no bearing on the policies or politics of the Islamic Republic.

Foreign economic hardships have typically affected the welfare of households primarily through unemployment and inflation. Despite the fact that formal sector employees with fixed-term contracts and informal workers are deprived of Iran’s generous unemployment insurance, public employees are not affected by the unemployment caused by the sanctions. However, the inflation caused by sanctions adversely affected all Iranian households to a varying degree. A detailed analysis of Iranian household consumption patterns indicates a 21 percent decline in real expenditures after two episodes of sanctions between 2011 and 2020. Using Iran’s HIES data, this study found that Iranians have decreased their spending on education, health, entertainment, and transportation, while increasing the real value of their housing spending by 36 percent in 2020 as compared to 2011. Overall, there were significant differences in the adverse effects of sanctions experienced by families headed by formal workers, informal workers, and the unemployed.

Employees in formal employment, especially those in the public sector, enjoy greater economic security. On average, households headed by formal workers have spent 1.5 to two times more than households headed by informal workers. At the same time, they are the primary recipients of all national welfare programs such as unconditional cash transfer programs, Justice shares plans, affordable housing plans, and unemployment insurance. Likewise, public employees are also exclusively provided with non-cash compensation, bonuses, health care services, subsidized loans, food, and entertainment by their employer. A number of government institutions, particularly all military organizations, provide additional welfare services through their employee cooperatives. In contrast, informal workers and a portion of formal workers in Iran’s private sector do not receive this kind of exclusive economic and social assistance. In the absence of an inclusive social welfare system, a significant portion of Iran’s population, especially needy populations with limited political influence, receives residual state benefits.

In the aftermath of the Islamic Revolution, numerous attempts were made to convert the urban-elite-based system of social welfare into a more inclusive system to meet the basic needs of the vulnerable population. A number of revolutionary institutions and para-governmental organizations were established, and various social support programs were implemented, which in turn expanded the social welfare coverage. The implementation of new housing, educational, and health policies resulted in a decrease in poverty and an increase in human development. Despite all efforts, constructing a universal and inclusive social welfare system proved elusive due to several factors. These included a lack of comprehensive data infrastructure, mismanagement, multiple decision-making centers, and in particular, conflicts of interest with parallel para-governmental welfare institutions which further hindered progress towards this goal. Instead, the failure to establish a universal and inclusive social welfare system has led to the creation of a privilege-based welfare system.

Iran’s privilege-based system has significant implications for economic sanctions effectiveness. As illustrated throughout this analysis, despite sanctions undermining the government’s ability to fund public social programs, the system has created a multi-tiered welfare system that favors the ruling bloc, comprising those who exert political influence, formulate policies, or oversee state functions and governance services. Conversely, it has left underprivileged segments without adequate social support. Consequently, the burden of economic sanctions has been unevenly distributed, disproportionately affecting vulnerable individuals and impeding sanctions’ effectiveness in translating foreign economic pressure into domestic political pressure. Therefore, Iran sanctions have resulted in “civilian pain” without yielding significant political gain for the United States.

ENDNOTES

Hufbauer, G. C., Schott, J., Elliott, K. A., & Oegg, B. (2007). Economic Sanctions Reconsidered: Peterson Institute for International Economics.

Jones, Lee. 2015. Societies under siege: Exploring how international economic sanctions (do not) work. Oxford University Press, USA.

Kahalzadeh, Hadi. 2022. “Iran After Trump: Can Biden Revive the Nuclear Deal and Does Iran Even Want to?” Middle East Briefs: 33971.

Jones, Lee. 2015. Societies under siege: Exploring how international economic sanctions (do not) work. Oxford University Press, USA.

ibid

Torbat, Akbar E. 2005. “Impacts of the US trade and financial sanctions on Iran.” World Economy 28 (3): 407-434.

Gharehgozli, O. 2018. “Synthetic Control and Dynamic Panel Estimation: A Case Study of Iran.” City University of New York.

Katzman, Kenneth. 2019. Iran sanctions. Vol. RS20871. Congressional Research Service: Congressional Research Service.

Kahalzadeh, Hadi. 2022. “Iran After Trump: Can Biden Revive the Nuclear Deal and Does Iran Even Want to?” Middle East Briefs: 33971.

Secretary of State Mike Pompeo said CBS News on February 14, 2019 that “We are convinced that [the US sanctions] will lead the Iranian people to rise up and change the behavior of the regime.”

Kahalzadeh, Hadi. 2022. “Iran After Trump: Can Biden Revive the Nuclear Deal and Does Iran Even Want to?” Middle East Briefs: 33971

Reva, Anna. 2012. Living through crises: How the food, fuel, and financial shocks affect the poor. World Bank Publications.

Ha, Jongrim, M Ayhan Kose, and Franziska Ohnsorge. 2019. Inflation in emerging and developing economies: Evolution, drivers, and policies. World Bank Publications.

Abdi, Sara, and Fahimeh Bahrami. 2020. The image of consumption and welfare of Iranian households & policy recommendations. Bureau of Social Welfare Studies, Bureau of Social Welfare Studies (Ministry of Cooperatives, Labour, and Social Welfare: Labour Ministry of Cooperatives, and Social Welfare ).

Laudati, Dario, and M. Hashem Pesaran. 2021. “Identifying the Effects of Sanctions on the Iranian Economy Using Newspaper Coverage.” SSRN Electronic Journal. https:// doi.org/10.2139/ssrn.3898315. https://dx.doi. org/10.2139/ssrn.3898315.

Gheissari, Hamid, and Nooh Monavvary. 2020. “Rethinking unemployment insurance.” Governance and Community Empowerment Center of Jahad Daneshgahi 152.

ibid

Alaedini, Pooya. 2021. Social Policy in Iran: Main Components and Institutions: Routledge.

Salehi-Isfahani, Djavad. 2019. “Iran’s economy 40 years after the Islamic Revolution.” Belfer Center 14.

Gentilini, Ugo, Margaret Grosh, Jamele Rigolini, and Ruslan Yemtsov. 2019. Exploring universal basic income: A guide to navigating concepts, evidence, and practices: World Bank Publications.

Farsian, Mohammadreza 2016. A general review of situation of housing and urban development and urban management. (Tehran, Iran).

Tajmazinani, Ali Akbar. 2021. Social policy in the Islamic world: Springer.

Mohamadi, Efat, Alireza Olyaeemanesh, Arash Rashidian, Ali Hassanzadeh, Moaven Razavi, and Abbas Rahimi Foroushani. 2017. “Stakeholders Analysis of Health Insurance Benefit Package Policy in Iran.” Health Scope 7 (2). doi: 10.5812/jhealthscope.63165.

Mohamadi, Efat, Amirhossein Takian, Alireza Olyaeemanesh, Arash Rashidian, Ali Hassanzadeh, Moaven Razavi, and Sadegh Ghazanfari. 2020. “Health insurance benefit package in Iran: a qualitative policy process analysis.” BMC Health Services Research 20 (1). doi: 10.1186/s12913-020-05592-w.

Tajmazinani, Ali Akbar. 2021. Social policy in the Islamic world: Springer.

ABOUT IRAN UNDER SANCTIONS

Iran is the most sanctioned country in the world. Yet, there has been little investigation of the systemic impacts sanctions have had beyond their targeted economic effects. The focus has often been on a few metrics that flare up with tightening of sanctions: currency depreciation, inflation, and recession, which are then followed by increases in unemployment and poverty. But the more comprehensive picture is lost in political cacophony around the policy’s merits. This is the gap that SAIS is filling with its Iran Under Sanctions project. This multi-year interdisciplinary project aims to provide a holistic perspective of the consequences of sustained sanctions to help inform the political and academic discourse surrounding this widely used foreign policy tool. For any questions or feedback on the project, please reach out to Narges Bajoghli at narges.bajoghli@jhu.edu.

The SAIS Rethinking Iran Initiative

Johns Hopkins University Washington, D.C.

Copyright 2023. All rights reserved.